Risk assets, in general, fell again last week as concerns over inflation, Federal Reserve rate hikes, the omicron variant, and geopolitical tension weighed on investors. The S&P 500 index (a proxy for US large cap stocks) fell over five percent for the week, marking its worst weekly drop since the depths of the pandemic in March 2020, while the MSCI ACWI (a proxy for large cap global stocks) retreated more than four percent.[1][2]

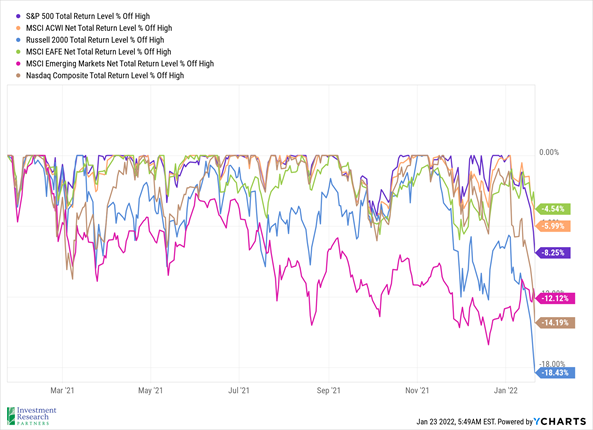

Despite the pullback in equities this year, the S&P 500 index is still only about eight percent lower than its all-time high (purple line below). Other areas of the market, like small cap stocks (see the Russell 2000 below), have dropped much more significantly while foreign stocks (i.e., MSCI EAFE below) have held up relatively well by comparison.

It is important to remember in the midst of this market volatility that the US economy remains in good condition based upon the Conference Board’s Leading Economic Indicator (LEI) data. The LEI tracks ten economic indicators that, as a whole, tend to help signal turning points in the economy. The LEI rose again in December, with eight of the ten components improving. Based upon the most recent release, the Conference Board data suggests “that the expansion in economic activity will continue in the nearterm."[3]

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2021 |

| Crude Oil (US WTI) |

$84.83 |

$75.37 |

| Gold |

$1,836 |

$1,828 |

| US Dollar |

95.64 |

95.67 |

| 2 Year Treasury |

1.01% |

0.73% |

| 10 Year Treasury |

1.75% |

1.52% |

| 30 Year Treasury |

2.07% |

1.93% |

| Source: Morningstar, YCharts, and US Treasury as of January 22, 2022 |

Asset Class Returns

| Category |

Representative Index |

YTD 2022 |

Full Year 2021 |

| Global Equity |

MSCI All-Country World |

-5.5% |

18.5% |

| Global Equity |

MSCI All-Country World ESG Leaders |

-5.7% |

20.8% |

| US Large Cap Equity |

S&P 500 |

-7.7% |

28.7% |

| US Large Cap Equity |

Dow Jones Industrial Average |

-5.6% |

21.0% |

| US Small Cap Equity |

Russell 2000 |

-11.4% |

14.8% |

| Foreign Developed Equity |

MSCI EAFE |

-2.2% |

11.3% |

| Emerging Market Equity |

MSCI Emerging Markets |

1.0% |

-2.5% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

-1.4% |

1.5% |

| US Fixed Income |

Bloomberg Barclays US Agg Bond |

-1.8% |

-1.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-0.9% |

-4.7% |

| Source: YCharts as of January 22, 2022 |

[1] Source: Nasdaq, S&P Finish Worst Week Since Pandemic Onset - WSJ

[2] Source: YCharts

[3] Source: US LEI Technical Notes (conference-board.org)

Download PDF Version

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.