Key Events: Something for everyone

The data probably validated your opinion this week:

Retail sales, housing starts, and jobless claims came in better than expected and consumer sentiment rose to the highest level since the summer of 2021.

The Empire state manufacturing survey registered the largest decline since the pandemic.

Trump won the first 2024 GOP primary in Iowa.

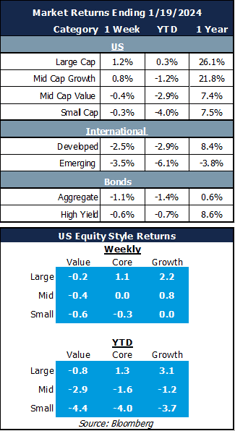

Market Review: Record highs for the S&P 500

This good data and consumer optimism carried the S&P 500 to its first new high since January 3, 2022.

Gains did not spread to other stock categories, though, as small and international stocks declined.

Bonds also lost money on reduced expectations for the magnitude of 2024 Fed rate cuts.

Outlook: Coping with delinquency

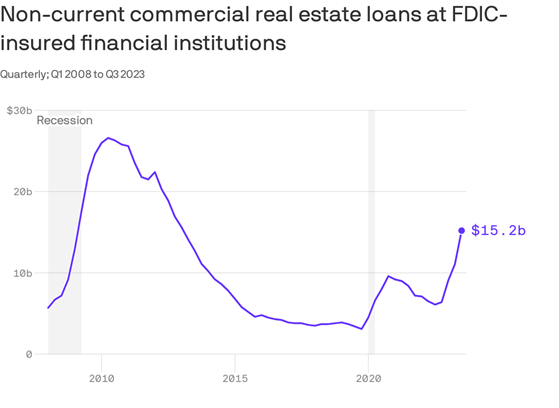

Let’s temper the S&P 500 enthusiasm a bit. We have discussed reduced bank lending as a potential drag on 2024 growth; commercial real estate delinquency levels are beginning to foreshadow slowing lending activity as bank balance sheets weaken. The chart below shows that bank holdings of delinquent commercial real estate loans has grown to levels approaching the financial crisis.

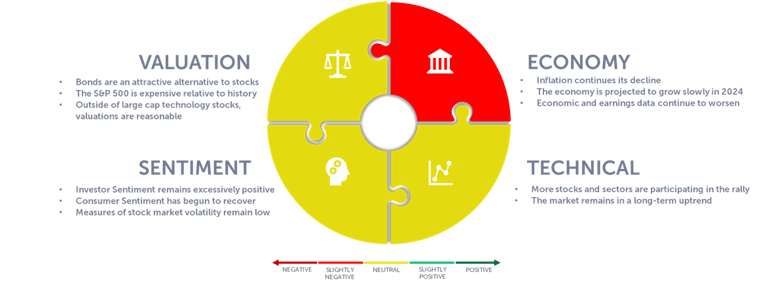

While we celebrate the positive economic data, portfolios remain balanced, structured to withstand the negative as well as benefit from the positive.

Real Estate Delinquency [1]

Navigator Outlook: January 2023

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Data: FDIC; Chart: Axios Visuals

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00642