Key Events: Inflation picks up

Consumer prices rose more than expected; Core CPI climbed 3.9%, well above the Fed’s inflation target driven by increases in housing prices. Meanwhile continued Houthi attacks on ships in the Red Sea may further stoke supply-chain inflationary pressures.

The SEC provided landmark approval for exchange traded funds that directly invest in Bitcoin.

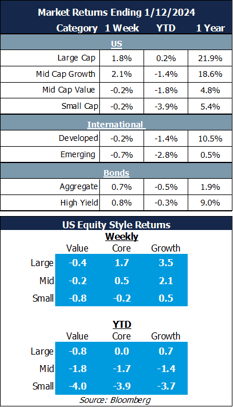

Market Review: A bumpy start to the new year

Stocks processed economic prospects: Large cap stocks gained, while small cap stocks remained in the red.

Bonds recovered from last week’s losses on hopes for rate cuts and a strong economy.

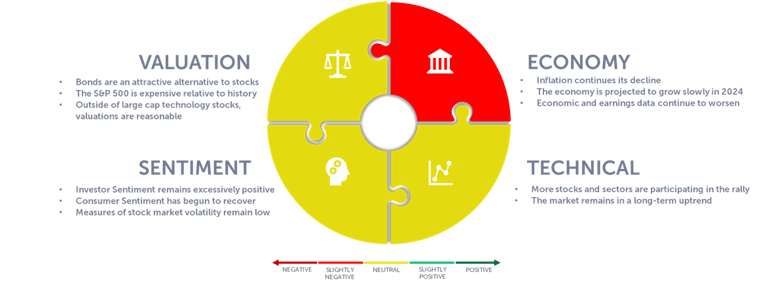

Outlook: …Uncertainty

An uncertain outlook greets us in the new year:

- Will we have a soft landing, recession, or “no landing”?

- When will the Fed cut rates, and by how much?

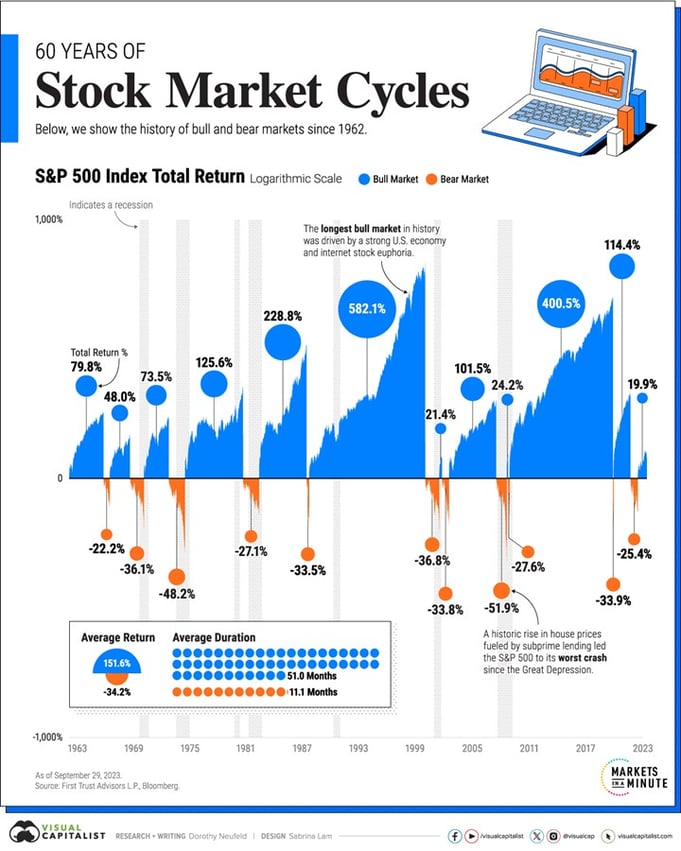

Answers to these questions will drive markets for the year. Our portfolios are diversified, with a broad mix of stocks and bonds. Markets move in cycles; OneAscent portfolios are prepared to thrive amidst the uncertainty of 2024.

Market cycles[1]

Navigator Outlook: December 2023

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Visual Capitalist Visualizing 60 Years of Stock Market Cycles (visualcapitalist.com)

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00605