Key Events: Discordant economic data

On Tuesday, bad news was bad: January’s Consumer Price Index report surprised to the upside causing rate cut expectations to shift further out into the future.

On Thursday, bad news was good: January retail sales were lower than expected, reducing rate cut worries.

On Friday, Bad news was bad again as the producer prices joined consumer prices in an upside surprise.

Market Review: Leads to harmonious markets

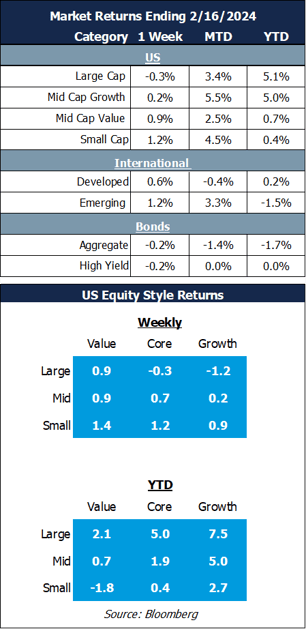

This cognitive dissonance didn’t have tremendous effect; the S&P 500 finished only slightly negative for the week. The stock market showed welcome breadth as small caps and international stocks all made money.

Inflation caused bond losses as yields reset higher.

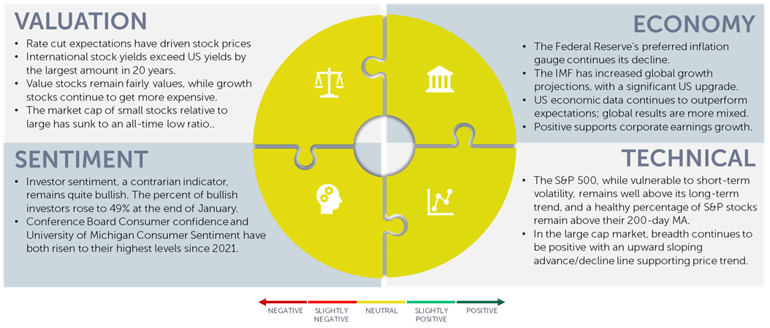

Outlook: Positive momentum

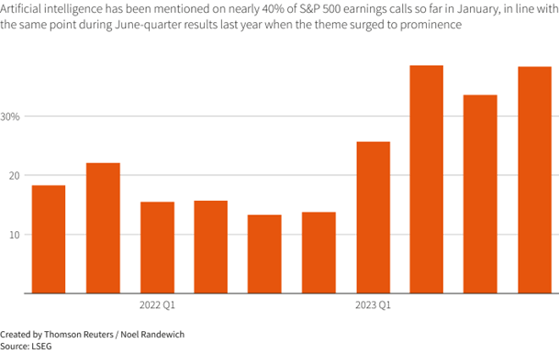

Company mentions of Artificial Intelligence on earnings calls[1]

This bodes well for 2024, as does continued strength in Artificial Intelligence. Company mentions of AI have risen dramatically during 2023, lending credence to strong revenue and profitability growth that the market expects. As the chart below reminds us, though, technology is cyclical; AI-exposed stocks dipped in 2022 along with mentions on earnings calls. While our portfolios maintain exposure to transformational technologies, we are broadly diversified with exposure to smaller companies and international companies.

Most markets are still well below all-time highs [2]

Navigator Outlook: February 2024

Download PDF Version

This material is intended to be educational in nature,[3] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg, OneAscent Investment solutions. Since 1960, 37 of 64 years have started with a positive January. Full-year returns averaged 12.64% in those years, relative to 10.16% average returns in all years. Theres is a slightly higher probability of gains in years with positive January returns.

[2] Source: Reuters 'AI' stays front-and-center on quarterly conference calls | Reuters

[3] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00652