Key Events: Breaking eggs to make a trade omelet

Trump continued his tariff rampage with reciprocal tariffs as well as 25% tariffs on aluminum and steel.

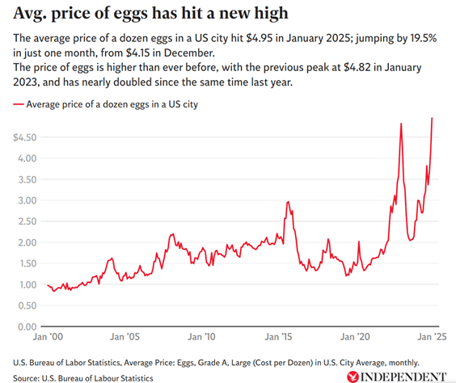

Inflation data surprised to the upside; both producer and consumer inflation surprised to the upside (see chart of egg prices below for example). Meanwhile, inflation expectations – which affect behavior -remain above the Fed’s target, limiting the likelihood of further rate cuts.

Market Review: Stocks shake off inflation

Stocks took their cue from earnings rather than inflation this week:[1] The S&P 500 gained ground while international stocks had even stronger gains.

Bonds gained slightly despite the inflation surprises as markets seem to have priced in fewer rate cuts.

Outlook: Anchoring to long-term expectations

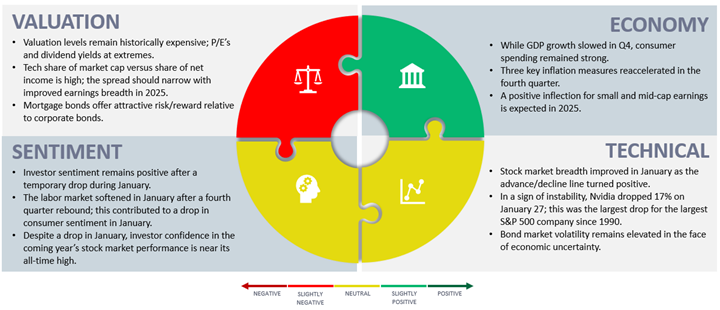

Stock valuations remain stretched, creating uncertainty that is exacerbated by the stubborn inflation data. When high valuations, narrow market performance or the uncertain outlook for inflation cloud our vision we must coach ourselves to act in our own best interest.

We minimize our cognitive errors such as recency bias, the tendency to focus on recent experiences - such as technology stock gains – rather than the fundamentals. Valuations and earnings growth suggest a broader opportunity set going forward. For instance, mid cap stocks have begun to perform; they present compelling opportunities.

In times of uncertainty and change, we counsel investors to remain focused on building strong, diversified portfolios anchored to the long-term fundamental opportunities the market presents.

Navigator Outlook: February 2025

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Factset – analysts expect S&P 500 earnings to grow 12.7% in 2025

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01151