Key Events: The Fed throws cold water on ‘the pivot’

Key Events: The Fed throws cold water on ‘the pivot’

Several Federal Reserve members spoke publicly, with a similar message – despite slowing inflation, there are more interest rate hikes to come. [1]

The future is murkier; a softening economy forewarns the recession that is now a Wall Street consensus expectation. Most companies have reported 4Q earnings reports and, as expected, profits continue to decline.[2]

Market Review: The pause that refreshes?

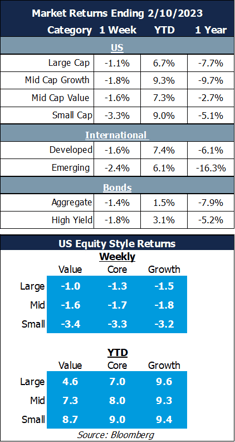

Large cap stocks held in better than most markets this week. The S&P 500 declined 1.1% while small-cap (-3.3%) international (-1.6%) and emerging markets (-2.4%) all lagged. Year-To-Date returns remain positive, and positive market technicals remain in place.

Outlook: The pause that refreshes faces off against the economic data.

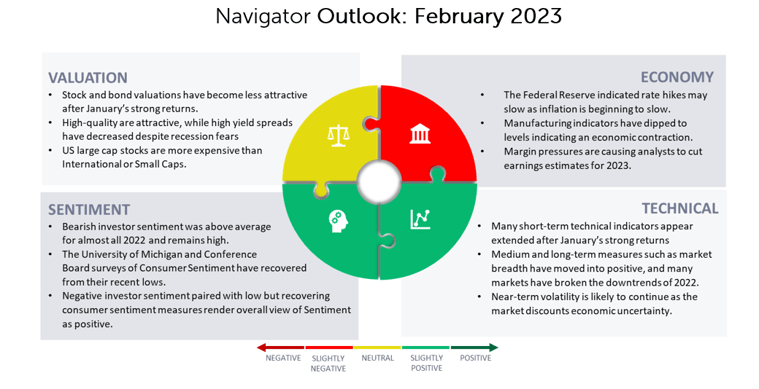

We expect volatility to continue while two competing narratives vie for acceptance.

One narrative says the economy is slowing, evidenced by slowing earnings and contracting manufacturing surveys; the stock market is likely to fall.

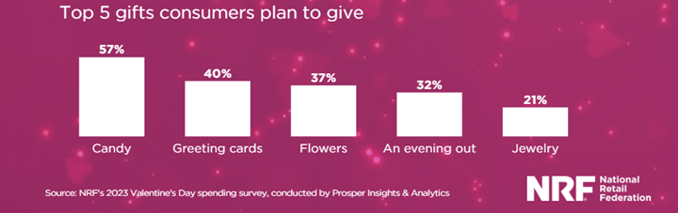

Another narrative says the market remains focused on the long term. The evidenced supporting this narrative includes strong market breadth and movements that have taken stocks above both long-term averages and the downtrends of 2022. Another set of data in the ‘long-term’ camp is continued strength of the consumer; this week we note Valentine’s spending is forecast to increase 8% in 2023 [3]; the chart below illustrates the breakout of that spending.

Download PDF Version

[1] Source: Bloomberg reporting on Federal reserve speeches: Fed’s John Williams Says Peak Rate Forecasts Still ‘Very Reasonable’ - Bloomberg, Fed’s Lisa Cook Says More Rate Hikes Needed to Curb Inflation - Bloomberg, Hot US Labor Market Signals More Interest Rate Hikes Needed, Fed’s Kashkari Says - Bloomberg

[2] Source: Factset

[3] Source: National Retail Federation

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00189