Key Events: A super week

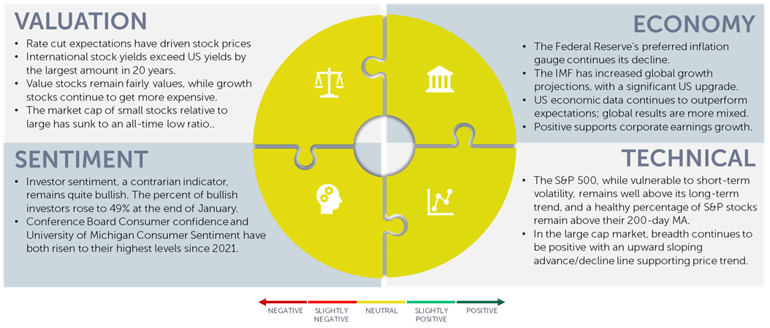

The economic data showed a strong economy and slowing in services inflation, confirming the market’s expectations for disinflation coupled with growth.

With 2/3 of companies reporting, the earnings are growing slightly more than expected at year-end. Profit margins declined from last quarter, remaining below the 5-year average and fourth quarter 2022.

Market Review: New highs

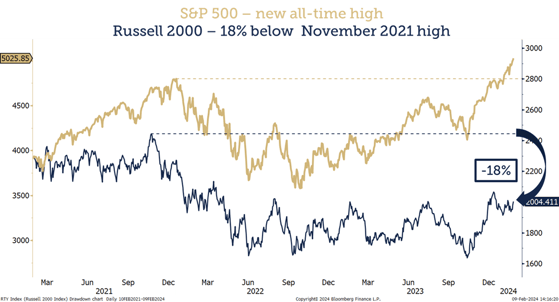

After recovering its all-time high in January, the market moved through 5,000, the next barrier.

Small caps joined the party – particularly growth stocks, which rose 3.5% on the week. Economic momentum in the US didn’t carry over to international markets though; developed market stocks were flat and emerging markets rose slightly during the week.

Outlook: Positive momentum

Markets often continue to gain after psychological barriers are broken. Two have been broken in the last couple of weeks; the S&P 500 regained its January 3, 2021, all-time high broke through 5,000 the 9th of February. Meanwhile, some measures of breadth are showing deterioration; we’d far prefer broader participation in the upside.

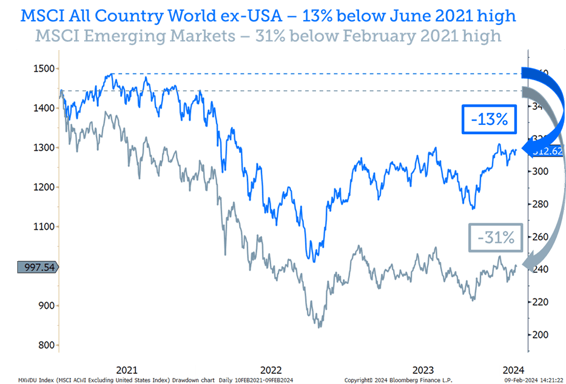

We also note that, as illustrated below, only the US large cap market has broken to new highs. Small caps have only recently broken out of bear market territory, now sitting 18% below their 2021 highs. International and emerging markets are also well below their highs. Our portfolios maintain a sensible balance between US large cap, small cap and international stocks, with a slight tactical overweight in US mid and large cap stocks.

Most markets are still well below all-time highs [1]

Navigator Outlook: February 2024

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg

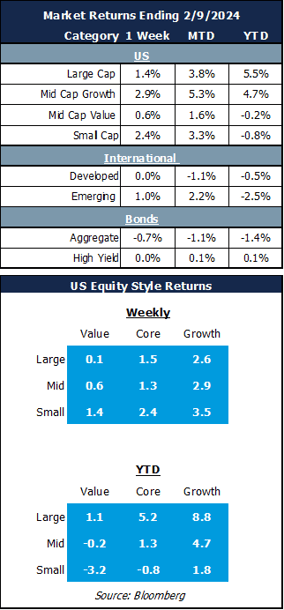

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00652