Weekly Investment Update February 10, 2025

February 10, 2025 •Peter Klingelhofer

Key Events: A cacophony of mixed signals

The week commenced with a spike in volatility due to the imposition of tariffs by the Trump administration on Canada, Mexico and China. By early evening on Monday, the 25% tariffs expected to be levied on Canada and Mexico were temporarily postponed.[1]

The Trump administration did implement a 10% tariff on all goods from China, to which China retaliated in kind with levies on some US products[2]. For some observers, “Trump-China Trade War 2.0 is underway”.[3]

Market Review: International stocks higher on the week

Global equities posted mixed performance for the first week of February. International equities made modest progress as US equities fell for the week. Diversification across global equities and market capitalization has proven to be beneficial thus far in 2025.

Investment grade bonds showed modest progress as the 10-year yield fell for the fourth consecutive week.

Outlook: Lingering tariff fears temper expectations

“Supply-side disruptions can have a material impact on aggregate inflation…it is dangerous to just ignore them”[4]stated Chicago Fed President Austan Goolsbee. Tariffs may impact inflation progress, and the “speed at which rates come down will be slower with more fogginess”.[5]

While Fed Governor Goolsbee raised concerns over Fed Funds rate expectations, Treasury Secretary Scott Bessent may have taken pressure off the Fed when he stated that the administration “is not calling for the Fed to lower rates”; they are “focused on the 10-year Treasury”[6]yield. Markets focus on the level and direction of the 10-year yield for asset pricing, but cues from the Fed set intermediate term expectations for risk.

Comments from Government officials are somewhat mixed on current rate concerns, but their long-term desires are consistent – they both want to see lower inflation and lower interest rates.

The current conundrum is that mixed signals aren’t confined to announcements about tariffs, rates and inflation by government officials. Mixed signals permeate economic data as well. The chart below shows the ISM Manufacturing New Orders series graphed against the ISM Services PMI data[7]. The New Orders series is a harbinger for an improved earnings outlook, and it has surged to its highest level since the first half of 2022. However, the ISM Services PMI missed expectations and showed signs of slowing growth.

Friday’s data reports only added to the theme of mixed data as job growth slowed more than forecast, yet the unemployment rate fell back to 4.0%[8]. Consumer sentiment fell for the first time in six months due to higher inflation expectations from tariffs[9]. With this cacophony of mixed signals, it’s paramount for investors to maintain focus on the long-term. Stocks tend to rise with earnings over time, and the best news of the week may have been that 4Q earnings results are growing above expectations, up roughly 12%[10]year over year.

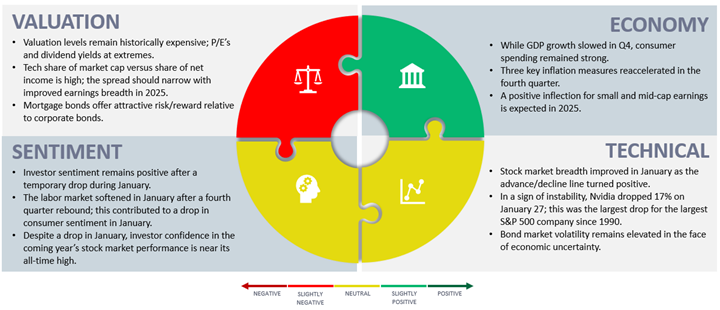

Navigator Outlook: February 2025

This material is intended to be educational in nature,[11] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg article.

[2] Source: Bloomberg: John Authers’ Columns: “Trump, Xi Play to Win Sun Tzu’s Art of Trade War”.

[3] Source: Bloomberg: John Authers’ Columns: “Trump, Xi Play to Win Sun Tzu’s Art of Trade War”.

[4] Source: Barron’s article: “Tariffs Could Derail the Fed’s Inflation Progress: Chicago Fed President Goolsbee” by Nicholas Jasinski.

[5] Source: Bloomberg via Benzinga Newsdesk on 2/7/2025.

[6] Source: Bloomberg: John Authers’ Columns: “Bessent Explains Trump. It Won’t be the Last Time.”

[7] Source: Bloomberg data.

[8] Source: Employment data from BLS via Bloomberg.

[9] Source: Bloomberg – University of Michigan Consumer Sentiment.

[10] Source: JP Morgan “Equity Strategy: 4Q Earnings Season Tracker” by Mislav Matejka.

[11] Source: Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01150