Key Events: Increasing optimism

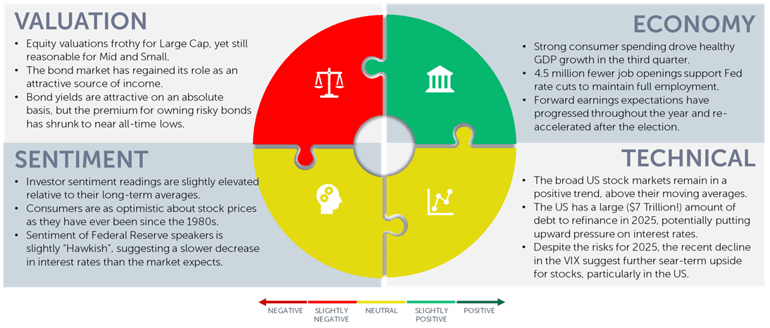

Economic data continues to improve: The 4Q Atlanta Fed Real GDP Nowcast increased to 3.3%, while manufacturing surveys and consumer sentiment improved. The unemployment rate, however, ticked up to 4.2%, up from 3.4% in 2023.

Israel and Hezbollah accused each other of breaches to their ceasefire and fighting continued in Ukraine amidst heightened Russian rhetoric.

Market Review: A pause from the rally

US Stocks took a pause after their November rally but large cap stocks were supported by tech gains.

International stocks recovered some from their November decline, while bonds showed slight gains.

Outlook: Processing a new administration

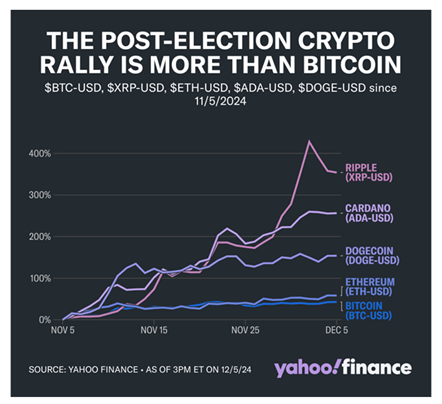

We do not spend much time discussing Bitcoin or other Cryptocurrencies, but the chart below shows their monstrous gains since Trump’s election. Bitcoin is up 40%, and smaller tokens are up far more. Does this say anything about how cryptocurrencies or other sectors may perform during a Trump presidency?

The outlook is positive: Trump’s SEC pick is perceived to be crypto-friendly, and Trump is expected to have a bias towards less regulation, benefitting stocks. Greater protectionism, though, is expected from a Trump Presidency. This has led to strong gains in US Stocks since the election, as the market anticipates healthy US Growth in 2025 and forward.

While we see increased opportunity in the US stock market, our portfolios remain diversified, with a slight ‘risk-on’ stance in our tactical portfolios.

We encourage investors to maintain their discipline.

Crypto currencies rally since Trump’s win1

Navigator Outlook: December 2024

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: yahoo finance

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01058