Key Events: How close is "close"?

The Federal Reserve is “close” to being done with rate hikes. In a highly anticipated speech, Chair Powell re-iterated progress on the three components of inflation:

- Goods prices have come down quickly.

- Housing costs have fallen, but slowly.

- Non-housing services such as healthcare, food and transportation are not declining quickly enough.

He reiterated that non-housing services are more connected to labor costs than other areas of inflation.

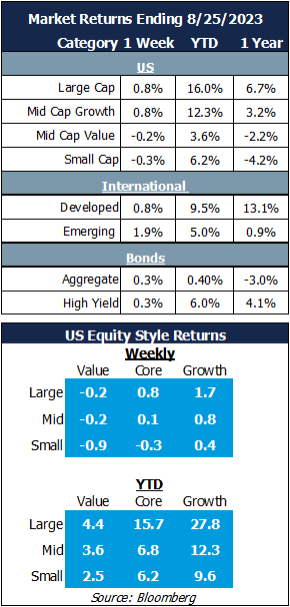

Market Review:

US Stocks ended the week with modest gains after see-sawing through the week. In the end, most stock and bond markets finished the week on a positive note.

Larger, more growth-oriented stocks performed best for the week, returning to the trend that has defined the year.

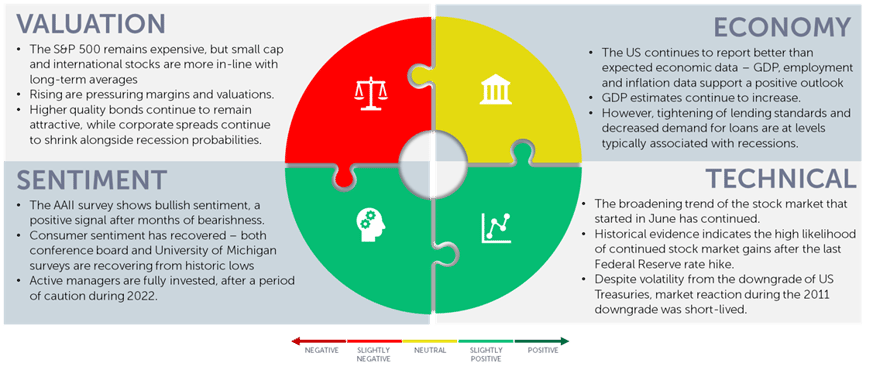

Outlook: Evaluating clouds on the horizon

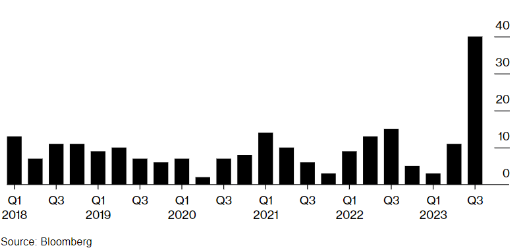

Chair Powell’s comments highlight that the labor market – the consumer - will likely suffer while the Fed brings inflation down to target. This is a large cloud on the horizon. Another, highlighted below, is the resumption of student loan payments, which has companies worried.[1]

Chair Powell finished by saying “we are navigating by the stars under a cloudy sky”. OneAscent’s “stars” are values-alignment, long-term focus and diversification. These will serve us well during these cloudy times.

Mentions of 'Student Loan' in Earnings Calls Jumped

Navigator Outlook: August 2023

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg When Are Student Loan Repayments Due? Consumer Companies Warn on Hit - Bloomberg

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggretate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00415