Key Events: The Fed charts a new course

Fed Chair Powell laid out a new course at the Jackson Hole monetary conference; with inflation progressing towards the Fed’s target, “The time has come for policy to adjust…the timing and pace of rate cuts will depend on the incoming data, the evolving outlook and the balance of risks.”

Vice President Kamala Harris laid out minimal policy details after receiving the Democrat nomination. Election ads will plague us for 71 more days.

Market Review: The market likes the new course

Markets loved the Fed’s dovish pivot. Risky US assets gained the most this week: small and midcap stocks outperformed large caps, and high yield bonds outperformed treasuries.

Real Estate, a beneficiary of lower rates, led sector returns, joining the positive bond reaction to the Fed pivot.

Outlook: Looking through the noise

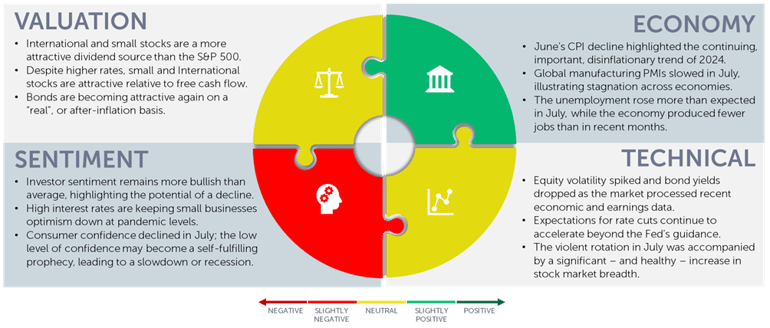

Expectations for the economy and Fed rate cuts are top of investors’ minds; the economy is giving mixed messages right now, but on Friday the Fed indicated they would provide support as needed – the “Fed put” is back - even though the stock market is at all-time highs.

Given the mixed economic messages and the fact that the market has so aggressively priced in rate cuts, we are not adding excessive risk to portfolios; we are fully invested, maintaining an allocation that we believe is likely to gain if the hoped-for soft landing materializes, but won’t get hurt too badly if the market hits a bump in the road.

Proper perspective on current events [1]

Navigator Outlook: August 2024

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Oaktree Capital Management, LP Mr. Market Miscalculates (oaktreecapital.com)

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00920