Global equity markets, in general, fell last week as concerns about central banks potentially easing support measures in the near future intensified[1]. Investors may get a better sense of the Federal Reserve’s tapering timeline later this week when the annual Jackson Hole symposium begins on Thursday. The S&P 500 index (a proxy for large-cap US stocks) fell 0.6% while the MSCI ACWI index (a proxy for global large-cap stocks) fell even more, retreating 1.8% during the week.

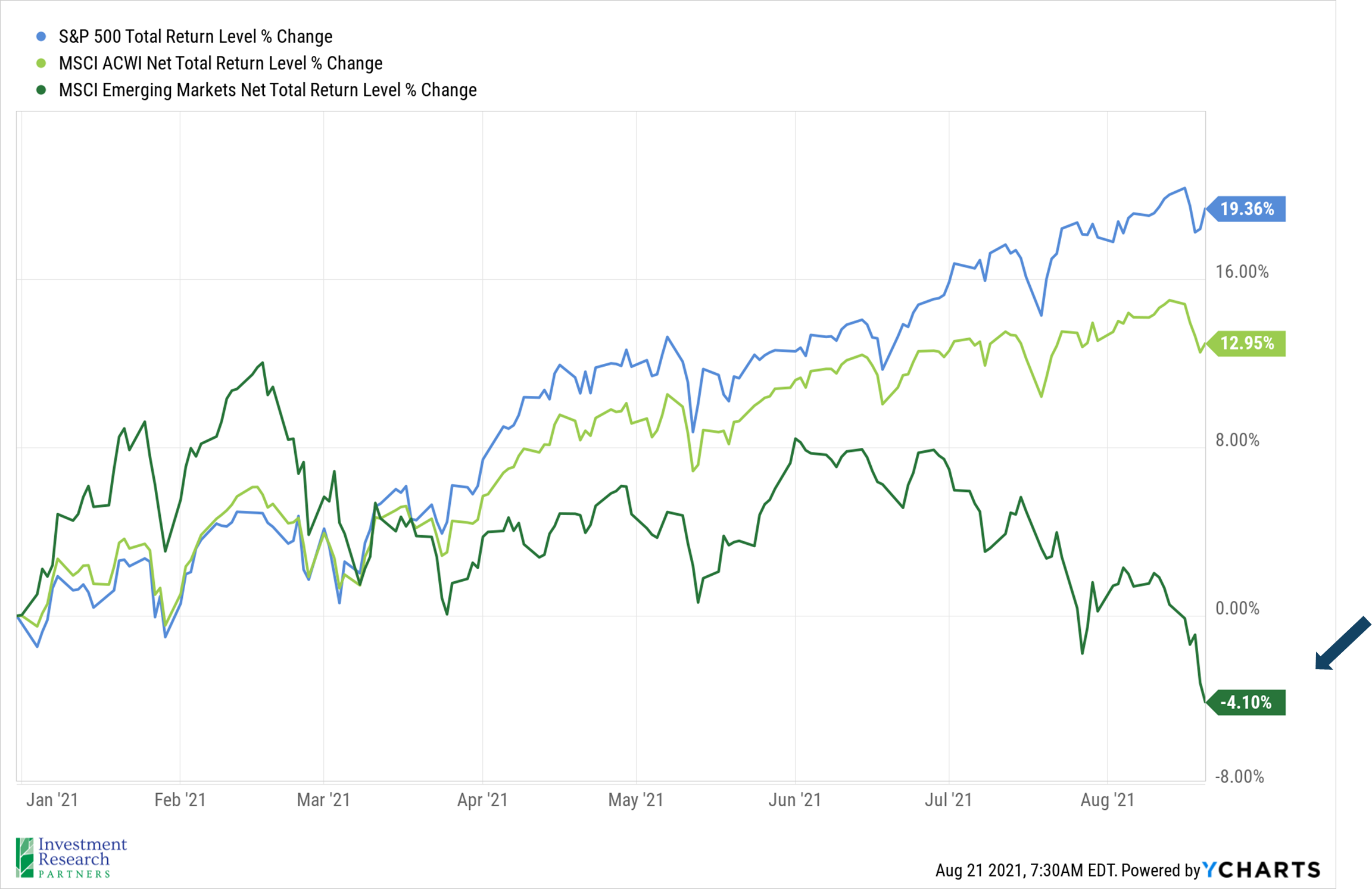

Emerging market equities were one of the worst performing equity asset classes, falling 4.6% during the week. After performing well to begin 2021, emerging market stocks (represented by the MSCI Emerging Markets Index below) began lagging the S&P 500 and MSCI ACWI in late Q1 and are now in negative territory for the year.

There are many contributing factors to the recent underperformance, including geopolitical tensions escalating between the US and China, the resurgence of Covid-19 concerns related to the Delta variant, the Taliban taking control of Afghanistan, and Chinese authorities cracking down on technology companies. We will be watching developments closely to see if the correction provides attractive investment opportunities for clients.

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2020 |

| Crude Oil (US WTI) |

$61.86 |

$48.52 |

| Gold |

$1,780 |

$1,893 |

| US Dollar |

93.46 |

89.94 |

| 2 Year Treasury |

0.23% |

0.13% |

| 10 Year Treasury |

1.26% |

0.93% |

| 30 Year Treasury |

1.87% |

1.65% |

| Source: Morningstar, YCharts, and US Treasury as of August 21, 2021 |

Asset Class Returns

| Category |

Representative Index |

YTD 2021 |

Full Year 2020 |

| Global Equity |

MSCI All-Country World |

13.0% |

16.3% |

| US Large Cap Equity |

S&P 500 |

19.4% |

18.4% |

| US Large Cap Equity |

Dow Jones Industrial Average |

16.1% |

9.7% |

| US Small Cap Equity |

Russell 2000 |

10.4% |

20.0% |

| Foreign Developed Equity |

MSCI EAFE |

9.2% |

7.8% |

| Emerging Market Equity |

MSCI Emerging Markets |

-4.1% |

18.3% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

1.6% |

5.2% |

| US Fixed Income |

Bloomberg Barclays US Agg Bond |

-0.7% |

7.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-2.5% |

9.2% |

| Source: YCharts as of August 21, 2021 |

[1] Stock Market Today: Dow, S&P Live Updates for Aug. 20, 2021 - Bloomberg

Download PDF Version

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.