Key Events: A big data week lightens the mood

The week provided plenty of data: Inflation and retail sales came in better than expected while housing starts disappointed – despite a drop in mortgage rates.

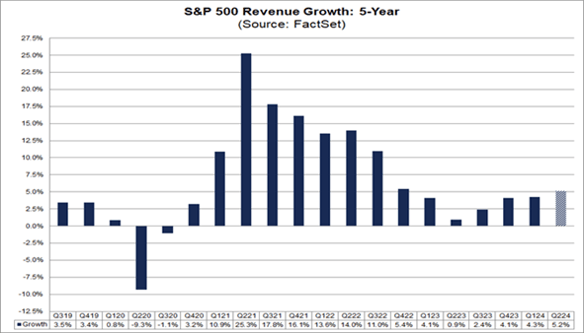

Revenues for the almost completed S&P 500 earnings season continue their modest recovery. (see chart below)

Small business and consumer sentiment improved, increasing the likelihood of strong economic growth.

Market Review: Volatility, what volatility?

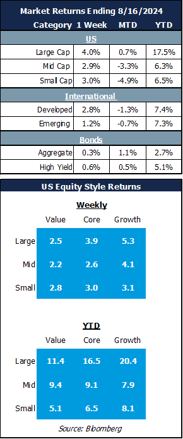

The S&P 500 shrugged off last week’s volatility, gaining 4%, the year’s largest S&P 500 weekly gain, while small and international gains were more subdued.

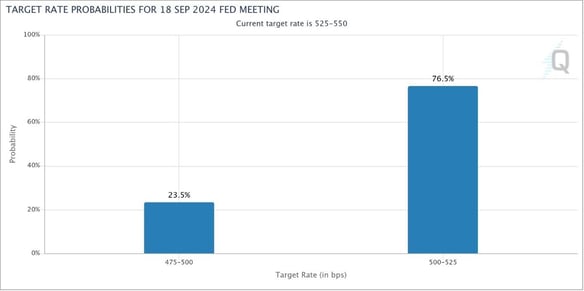

Bonds gained as expectations shifted to at least a ¼ point rate cut in September, with the potential for more.

Outlook: Please, sir, may I have another rate cut?

This return to risk taking rests in part on the premise that the Fed would cut aggressively, keeping the economy afloat. (see chart below) The increase in business and consumer sentiment resulted from this shift in mindset.

When consumers and businesses feel good – or at least less bad than earlier in the year – they make real decisions that move the economy forward. This is reflected in positive 2Q S&P 500 revenue growth, as shown below.

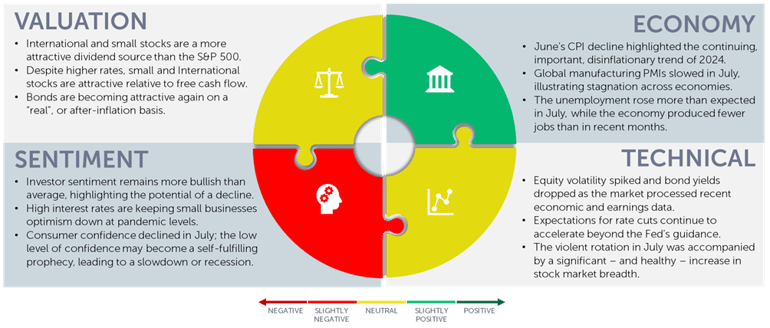

We acknowledge the importance of these sentiment readings while remaining on guard for signs of a further slowdown – it was just last week that the unemployment rate triggered a significant recession indicator.

We continue to maintain a portfolio allocation that we believe won’t get hurt too much if a recession occurs but is likely to gain if the hoped-for soft landing materializes.

S&P 500 Revenues are Recovering[1]

Bond Market Pricing 100% chance of a rate cut in September[2]

Navigator Outlook: August 2024

Download PDF Version

This material is intended to be educational in nature,[3] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: FactSet Research Systems

[2] Source: CME Fedwatch tool https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00918