Key Events: Tension - in the middle east and interest rates

An Israeli strike on the Iranian consulate in Syria and an IDF strike which killed aid workers raised regional tensions.

US Nonfarm payrolls advanced well above expectations last month and unemployment declined to 3.8%. Several Fed speakers tempered rate cut expectations.

Market Review: Time for a pullback

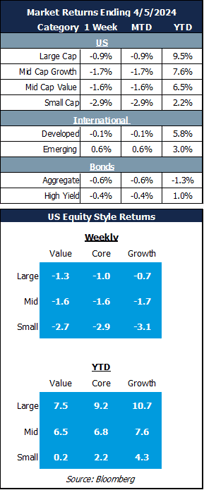

Markets reacted negatively to geopolitics and strong employment data – bonds sold off as rates are likely to stay higher for longer. This caused domestic stocks to sell off, with more interest-sensitive small cap stocks – particularly growth stocks - selling off the most. Large cap growth showed the lowest losses in the US markets.

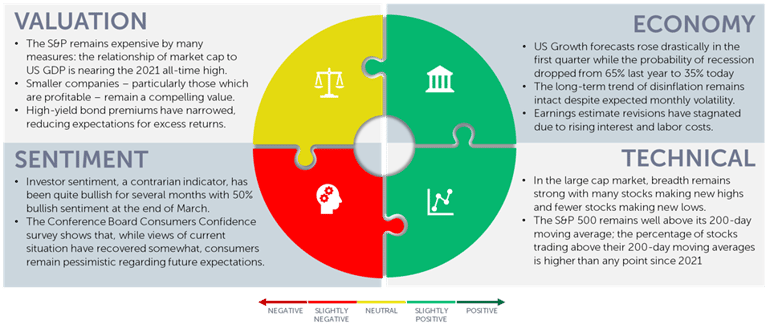

Outlook: Volatility and good news that’s bad

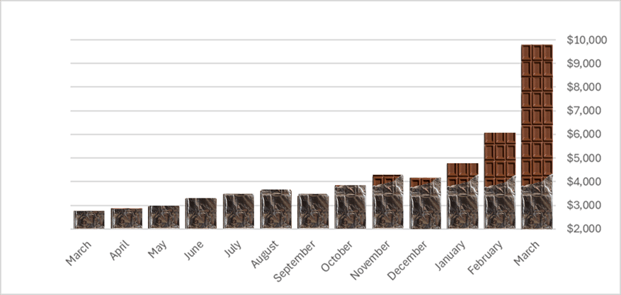

The market continues to grapple with the outlook for interest rates and economic growth. March’s employment situation was good, which (this week) was bad for the market as the Fed is now more likely to keep rates higher for longer. Expected 2024 rate cuts have gone from 3 down to 2. Inflation remains sticky for energy, as oil prices have risen due to the middle east conflict, but also in more niche areas such as chocolate (see chart below – this year’s Easter baskets did actually cost more!)

Our portfolios are broadly diversified. We caution investors about the risk of trying to time the market here March Madness and investing. Use this link to sign up for our quarterly webinar to hear more Quarterly Market Update Registration.

Inflation rearing its not-so-sweet head – Price of Cocoa [1]

Navigator Outlook: April 2024

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00700