Key Events: Stagflation fears resurface

First quarter GDP growth was below expectations, while inflation was higher, highlighting the downside risk of stagnant growth alongside high inflation.

Earnings growth is driving markets: with 46% of the S&P 500 reporting, earnings are up 3.5% year-over-year and are expected to grow 10% in 2024.

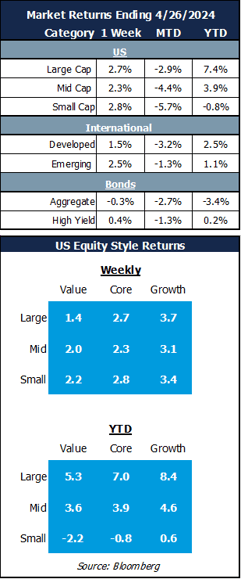

Market Review: Earnings drive a bounce in stocks

While the inflation data drove bond losses, earnings supported stock returns. Growth dominated as equities rebounded from a difficult month.

International stocks and high yield bonds gained as riskier assets rose across the board.

Outlook: Hope for the best, plan for the worst

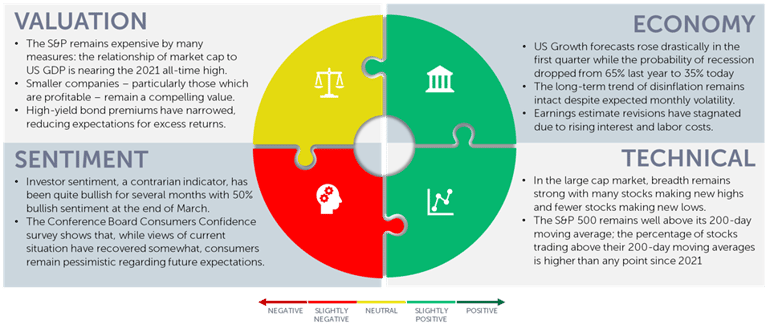

Analysts remain optimistic, expecting a soft landing and 10% earnings growth in 2024. Earnings are likely a key driver for the remainder of the year as higher interest rates should limit growth in stock valuations.

We are hoping for a soft landing while preparing for the worst: higher inflation or a recession. These outcomes have very little traction in the market, but each warrants some thought. Inflation remains sticky in several areas.

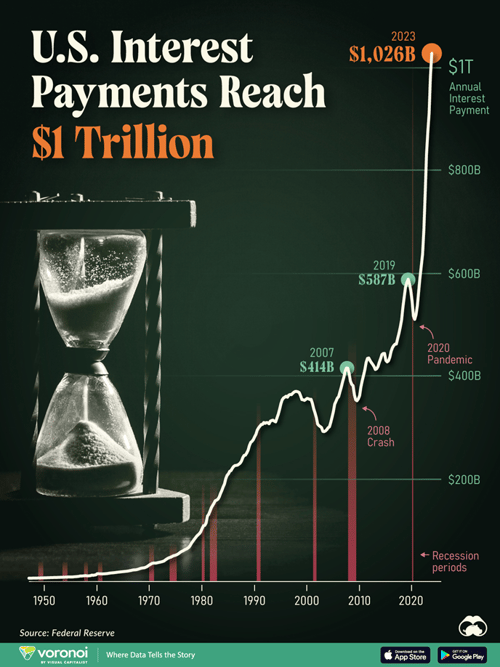

We give thought this week to recessionary risks. Pandemic stimulus has ended, but one thing hasn’t gone away - the bill is coming due. Interest payments on government debt have doubled since the pandemic. We have added $10 Trillion of debt between 2019 and 2023 – a 45% increase, while rates have gone from 2.5% to 4.6%[1] . Interest payments are a drag on growth.

That advice assumes that you actually know your risk tolerance. If you don’t, or think it might have changed, talk with your advisor.

We are preparing for this drag through diversification and a focus on company valuations as well as growth opportunities..

US Government Interest Payments[2]

Navigator Outlook: April 2024

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: US Treasury. The ten-year treasury bond yielded 2.53% on April 29,2019, and has climbed to 4.67% on April 26, 2024. visualcapitalist.com-US-debt-interest-payments-reach-1-trillion

[2] Source: Visual Capitalist Investors' Guide to Geopolitical Risk | Charles Schwab

[3] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00777