Key Events: Rapid Unscheduled Disassembly

Key Events: Rapid Unscheduled Disassembly

Starship’s fiery crash may serve as a metaphor for the economy; the launch was viewed as a success despite an eventual crash.[1]

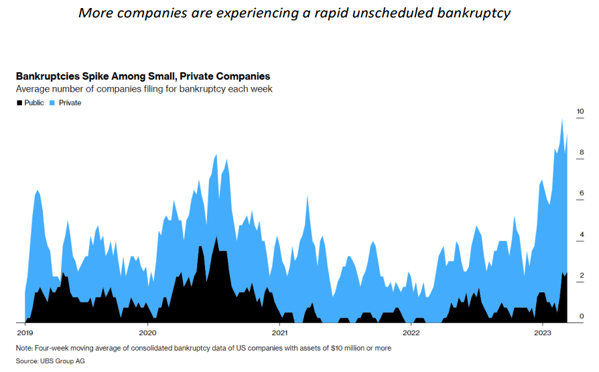

Likewise, while the SVB blowup was striking, the banking crisis has not yet led to a full-scale credit crunch, despite a rising number of bankruptcies and more difficult credit conditions.[2]

Market Review: Slight declines

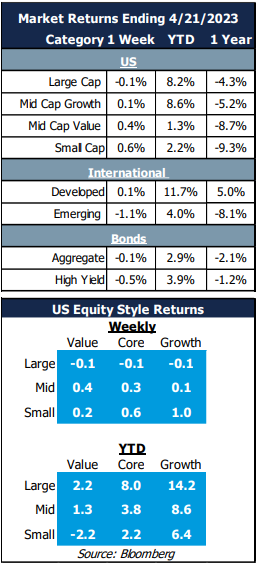

Markets were relatively calm this week. The S&P 500 lost just 0.1%, while smaller-cap stocks and bonds finished with slight gains. Emerging market stocks lost 1.1% for the week.

High grade bonds were down slightly, while high-yield lost ground due to heightened fears of a credit crunch.

Outlook: Feeling the effects, but looking past the slowdown

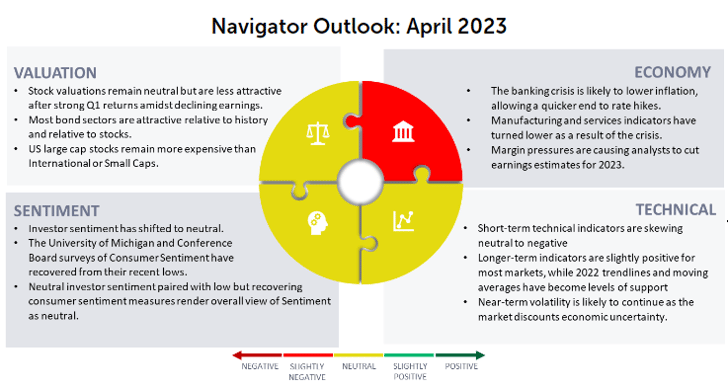

As the chart below shows, the number of bankruptcies is rising, and it’s slowing the economy. Rising S&P valuations increase the chance of a negative market reaction to bad news, and the economy is showing signs of instability: profits are down, mortgage rates remain high, and credit remains difficult to obtain.

The banking crisis has not, however, led to further banking failures. It’s possible the damage remains contained to SVB, which had very unique factors facilitating its fall.

As we look toward the most anticipated recession in history.[3]We are wise to expect a bumpy ride – both in the economic data and in the markets. While this week’s market action was tame, we are positioned for volatility and ready to take advantage of market weakness. OneAscent portfolios are diversified, and we remain disciplined in our balanced portfolio allocation.

i Sources: MSN Starship’s fiery crash was still a win for the future of spaceflight. Here’s why. (msn.com)

ii Sources: Bloomberg US Corporate Credit Crunch Means Bankruptcies, Rising Defaults (bloomberg.com)

iii Sources: Bloomberg What's Happening in the World Economy: The Most-Anticipated Recession Ever - Bloomberg

Download PDF Version

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00278