Key Events: Inflation and geopolitical worries

Bond yields rose as Fed Chair Powell cautioned the Fed would keep rates where they are as long as necessary given persistent inflationary pressures.

Middle East tensions escalated as Israel responded to Iran’s first ever direct attack on its territory.

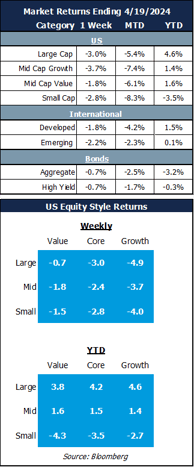

Market Review: Inflation fears drive volatility

Interest rates rose, driving volatility higher and stock prices lower - particularly higher PE growth stocks.

Improving economic data and lower valuations helped to limit international declines despite a strong dollar.

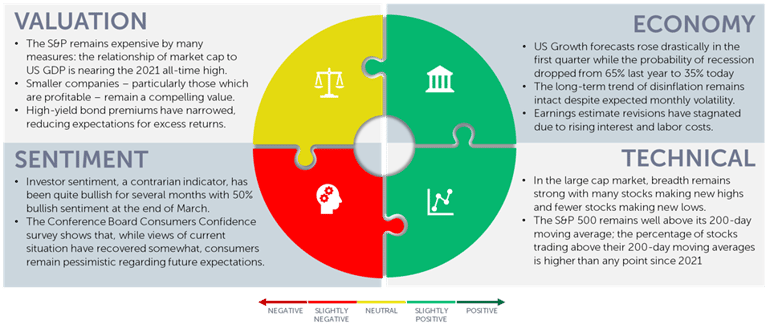

Outlook: Maintaining discipline through risky times

The market is beginning to digest earnings; analysts are optimistic, expecting 10% earnings growth in 2024. Earnings are likely to be a key driver of returns.

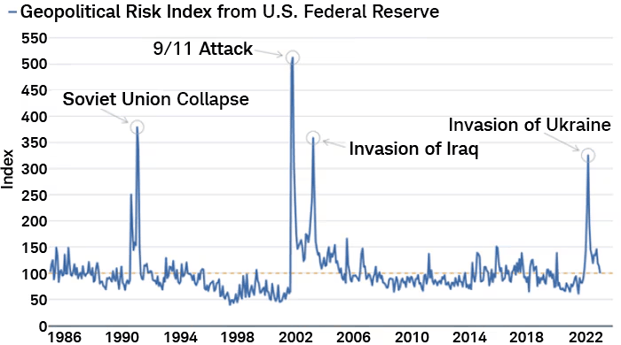

The middle east conflict is front and center in many peoples’ minds. Coupled with the war in Ukraine and tensions with China, there is a lot to worry about. We encourage investors to remember that while there is almost always a reason to sell, it is rarely the right move.

The chart below highlights an index of geopolitical risk. Each spike has been a great time to buy stocks when you look on a long-term horizon such as ten or twenty years. We encourage investors to stick with your plan, know your risk tolerance, and ignore the noise.

That advice assumes that you actually know your risk tolerance. If you don’t, or think it might have changed, talk with your advisor.

OneAscent portfolios are built to be resilient; Make sure that your investment plan is resilient as well.

Stock Markets and Geopolitical risk[1]

Navigator Outlook: April 2024

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Charles Schwab Investors' Guide to Geopolitical Risk | Charles Schwab

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00753