Key Events: Trump picks another fight

Trump threatened to fire Federal Reserve Governor Powell, arguing he should have lowered rates.[1]

Another set of inflation expectations rose[2], while retail sales and unemployment claims showed evidence of continued economic strength.

Market Review: Stocks react to a weaker dollar

The dollar retreated to a level below its pre-COVID high this week, benefiting international stocks at the expense of US issues. The S&P 500 lost 1.5%, while international stocks were up 3.9%.

Bonds recovered from their tariff-induced selloff but remain down for the month of April, while Gold again hit new highs on safe-haven demand.

Outlook: Remaining calm amidst the storm

Our investment philosophy is built on three key principles: investing according to our values, maintaining a long-term perspective, and constructing globally diversified portfolios. The Easter holiday offers a moment to reflect on how our faith enhances our investment approach.

With an eternal perspective provided by our faith, we can avoid the everyday anxieties that lead many investors astray. Anchoring our lives in goodness and truth, we similarly anchor our investments with a focus on long-term growth and diversification.

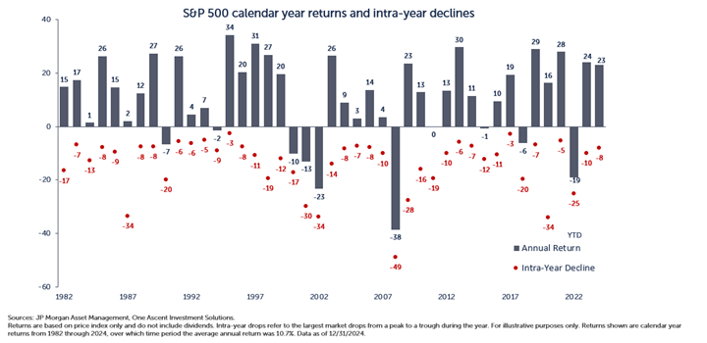

Despite the current political, economic, and market challenges, we remain steadfast. The S&P suffered a 19% decline[3]; the chart below illustrates that this volatility is normal. Our investment process is designed to navigate such times. We remain diversified and well-positioned to respond to market events. We encourage other investors to adopt a similar anchored approach.

While no one looks forward to market volatility, intra-year declines are normal and a historical perspective on the frequency and severity of past drops can provide a valuable perspective.

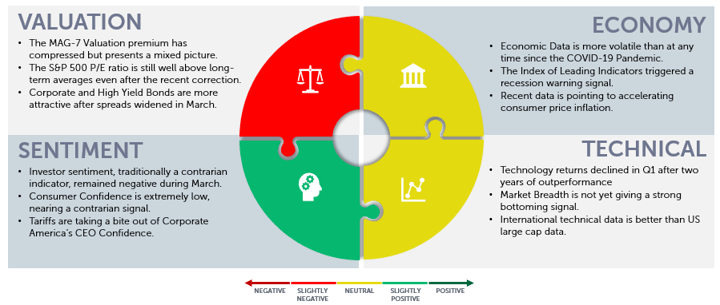

Navigator Outlook: April 2025

Download PDF Version

This material is intended to be educational in nature,[4] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: It is uncertain if the President could technically fire Jerome Powell. The Federal Reserve Act states that a board member can be removed “for cause by the President”, but what exactly qualifies as “for cause” is not defined. Federal Reserve Act

[2] Source: NY Fed 1-year inflation expectations rose to 3.58%, the highest level since September of 2023.

[3] Source: Bloomberg. At the time of writing, the S&P 500 is down 14% from the February high.

[4] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01193