Key Events: Art of the tariff deal

Trump’s tariff about-face on Wednesday triggered chaos in treasury bonds as a levered hedge fund strategy suffered losses[1] which roiled markets.

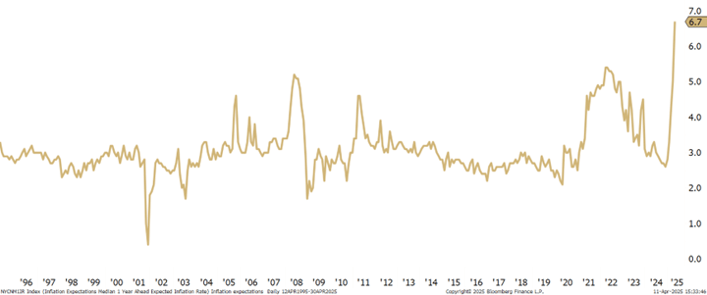

Inflation data came in soft, but inflation expectations rose to a highest in 40 years[2] as the tariff drama - particularly the escalating tensions with China - superseded other events this week.

Market Review: Bonds break bad

Unwinding of levered trades caused bond losses. After a horrid start to the month stocks, however, had one of their strongest days on Wednesday – the S&P 500 was up 9.5%, the largest one-day gain since 2008.

The sharp turnaround in stocks carried through with solid gains for US stocks; international stocks lagged on fears of tariff repercussions. Gold hit new highs as uncertainty increased safe-haven demand.

Outlook: Snow white and the seven tariffs?

Trump 2.0 has been received as poorly as the recent Cinderella remake; plot changes have been panned by audiences and critics alike. Trump tweeted about the stock market over 150 times in his first term; the reboot features his suggestion that we need to ‘take our medicine’ in the short term.

This analogy both illustrates why Trump has roiled the market so much and provides a path forward. If the event – tariffs – triggers a recession, it’s the resolution of those tariffs that will end it and allow the stock market to recover.

We can’t predict what Trump’s next move will be (can anyone?) but we know how to manage an investment portfolio through this episode of volatility. Tune in to our quarterly webinar tomorrow at 10:00 am central for the full story Webinar Registration - Zoom. The key is to have a plan and follow it; we’ll share how we are implementing our plan tomorrow.

Trump Tariffs Cause Spike in near-term Inflation Expectations

Navigator Outlook: April 2025

Download PDF Version

This material is intended to be educational in nature,[3] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: For an explanation of the trading strategy, see Basis trading - Wikipedia

[2] Source: University of Michigan. Consumers’ expectations for inflation in the next year rose to 6.7%, the highest level since 1981.

[3] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01187