After rallying in March, equity markets retreated last week. Investors expressed concern over the Federal Reserve (Fed) meeting minutes released on Wednesday, which communicated plans to reduce their balance sheet (alongside raising interest rates throughout the year). Time will tell whether the Fed is able to be aggressive enough to tame inflation without harming the economy. The continuing conflict in Ukraine and a resurgence of Covid-19 in China and elsewhere also weighed on investors last week.[1] The S&P 500, a proxy for large-cap US stocks, dropped 1.2% while the MSCI ACWI, a proxy for large-cap global stocks, fell 1.4%.[2]

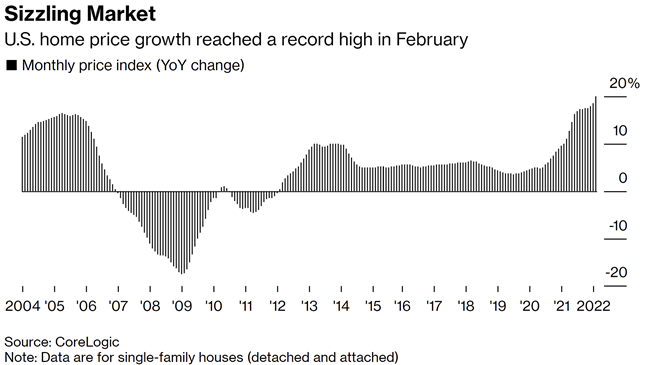

As readers of this commentary are most likely aware, the Fed has begun raising interest rates in an effort to rein in surging inflation. Rising home prices, as illustrated below, are part of the rising costs that we are all experiencing. However, what may not be as apparent is how rapidly mortgage rates are rising, as well. For example, the 30-year mortgage rate is currently at 4.67%, up over 50 percent over the past six months. The combination of the increasing home prices and mortgage rates jumping is beginning to price many potential buyers, especially those looking to buy their first home, out of the market.[3]

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2021 |

| Crude Oil (US WTI) |

$97.90 |

$75.37 |

| Gold |

$1,946 |

$1,828 |

| US Dollar |

99.84 |

95.67 |

| 2 Year Treasury |

2.53% |

0.73% |

| 10 Year Treasury |

2.72% |

1.52% |

| 30 Year Treasury |

2.76% |

1.93% |

| Source: Morningstar, YCharts, and US Treasury as of April 9, 2022 |

Asset Class Returns

| Category |

Representative Index |

YTD 2022 |

Full Year 2021 |

| Global Equity |

MSCI All-Country World |

-6.6% |

18.5% |

| Global Equity |

MSCI All-Country World ESG Leaders |

-7.8% |

20.8% |

| US Large Cap Equity |

S&P 500 |

-5.5% |

28.7% |

| US Large Cap Equity |

Dow Jones Industrial Average |

-3.9% |

21.0% |

| US Small Cap Equity |

Russell 2000 |

-10.9% |

14.8% |

| Foreign Developed Equity |

MSCI EAFE |

-7.7% |

11.3% |

| Emerging Market Equity |

MSCI Emerging Markets |

-8.1% |

-2.5% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

-7.0% |

1.5% |

| US Fixed Income |

Bloomberg Barclays US Agg Bond |

-7.9% |

-1.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-8.4% |

-4.7% |

| Source: YCharts as of April 9, 2022 |

[1] Source: Stock Market Today: Dow, S&P Live Updates for Apr. 8, 2022 - Bloomberg

[2] Source: YCharts

[3] Source: Soaring Mortgage Rates and Home Prices Fuel Desperation for U.S. Homebuyers - Bloomberg

Download PDF Version

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.