Monthly Update - September 2023

October 3, 2023 •Nathan Willis

Seeking Clarity

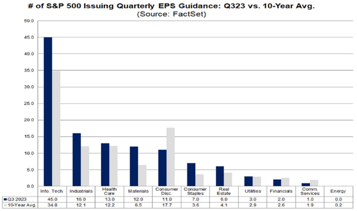

The S&P 500 has experienced a strong recovery from 2022 losses, led by improving economic data and AI-driven technology stock optimism. This optimism is also reflected in company expectations. More companies have provided guidance – indicating confidence in their outlook – than ever. The chart and quote below, from a September 29 FactSet report, illustrate this dynamic[1]:

Almost half (45 of the 116) companies that provided guidance were in the technology index, and almost 30% more technology companies than average have provided guidance. AI is certainly an economic force to be reckoned with; so is the consumer. The consumer sector is the only sector with a significantly smaller number of companies providing guidance, reflecting heightened uncertainty.

This makes sense, given the forces at play:

- High oil prices, leading to increased inflationary pressures

- High mortgage rates and increasing delinquencies in credit card and auto debt

- The resumption of student loan payments this month

Consumer spending accounts for more than 2/3 of the US economy; it is important to address consumer as well as corporate expectations. Before we look to the future, let’s review September returns, shown in this chart:

consumer as well as corporate expectations. Before we look to the future, let’s review September returns, shown in this chart:

September Market Review

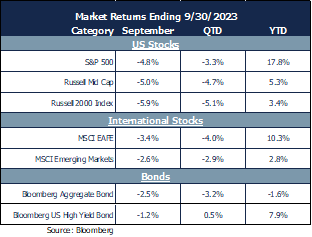

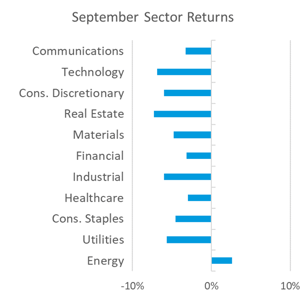

September took a bite out of stock market returns as stocks fell across the spectrum:

- Large US stocks ended down 4.8%, while mid and small stocks fell more, and international and emerging markets fell less than US stocks

- Bonds lost money as energy prices kept inflation concerns front and center. Bond yields have accelerated above their 2022 highs

- As in August, energy was the only sector to make money as Oil exceeded $90.

Let’s review our Navigator framework to develop expectations for the fourth quarter.

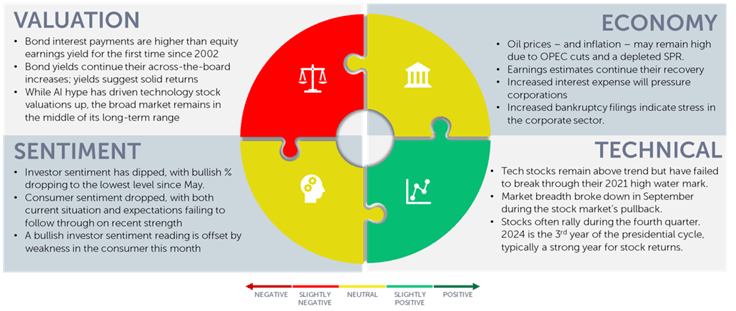

October 2023 Navigator Outlook

Economy: OPEC production cuts, paired with a depleted Strategic Petroleum Reserve and stronger than expected economy, have served to keep energy prices – and inflation – high, at least in the near term. Earnings estimates continue to recover modestly, but headwinds are emerging. In addition to a potentially stressed consumer, increased interest expenses are likely to pressure margins, evidenced by higher corporate bankruptcy filings so far in 2023, than all of 2021 or 2022.

Technicals: Technology stocks remain above their long-term trend but have failed to break through their 2021 highs, inviting doubts as to the sustainability of the rally. Market breadth worsened during September’s pullback. Optimism can be found in the fact that the fourth quarter is typically strong, and 2024 is the third year of the presidential cycle, when stocks often perform well.

Sentiment: Investor sentiment dipped, with the percentage of bullish investors dropping to the lowest level since May. Consumer sentiment dropped, with both current situation and future expectations showing concern as high interest rates darken the consumer horizon.

Valuation: The bond market (Bloomberg Aggregate) pays higher interest rates than the earnings yield of the S&P 500, which last happened in 2002. Bond yields have risen across the board, suggesting attractive returns across the spectrum of credit risk. Looking further afield than the US large cap market, stock valuations are closer to their long-run averages.

Outlook and recommendations: Great Expectations?

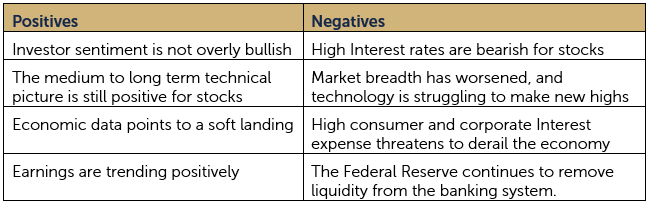

After quoting from great expectations last month, we now question how great the expectations should be. Despite companies’ confidence in their earnings, a sober look at reality is more balanced. Let’s review some positives and negatives:

While the current picture looks like a soft landing, the future is less certain due to the fact that we are in the midst of an unprecedented experiment: interest rates have never risen so far, so fast, and the money supply has never grown as fast as it has over the last 15 years, followed by such an abrupt shrinking.

We urge investors to Maintain discipline amidst the uncertainty. Remain focused on your destination and follow your plan. We recommend the following; just has we have for several months:

- Remain diversified. In particular, bonds offer return potential in a way they haven’t for some years, and many stock markets outside the S&P 500 present sound opportunities.

- Consider alternative investments. Strategies with low correlation to the overall markets meet a crucial need in many portfolios.

- Remain invested. Taking these points to heart will help you stay the course.

While the evidence gives us less optimism than last month, we remain fully invested in a portfolio which ensures that we are ready and willing to take advantage of opportunities that market volatility may present.

[1] Source: FactSet Earnings_Insight_092923 (factset.com)

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00428