Monthly Update - November 2024

November 5, 2024 •Nathan Willis

October Review – Rethinking the rate cut cycle

The stock market churned in October, ending down slightly as the market reduced its expectation for rate cuts. These two charts illustrate the change in expectations: the market expected 9 rate cuts, but the left chart shows an abrupt shift based on Fed comments when they kicked off this rate cutting cycle. The market has reduced expectations for rate cuts, now expecting four cuts by mid-year 2025.[1]

The GDP chart on the right helps explain the shift. The Fed – and market- have shifted their focus from the inflation battle to ensuring a soft landing; the 3Q GDP report showing 2.8% growth allowed full-year estimates to grow to 2.6%[2]Will economic growth stay strong, and does the Fed need to keep cutting rates?

We will address those questions in our outlook. Let’s review October’s returns.

October Market Review

Stocks took a breather in October, digesting fewer expected rate cuts:

- Large cap stocks dropped by a percent; they remain up 21% for the year.

- International and Emerging Markets pulled back as the market was unimpressed with China’s stimulus measures.

- Investment grade bonds lost ground as increased growth drove yields higher.

- High Yield bonds held value better as strong growth will likely limit defaults.

Stock sector movements were not particularly consistent, reflecting a shifting narrative:

- Financials performed well while other interest sensitive sectors – Real Estate, Utilities, and industrials – were middle of the road.

- Healthcare, a defensive sector, was the worst performer for the month and is tied for worst YTD, as the post-COVID path has been bumpy.

- Communications and Energy joined Financials as the only sectors showing positive returns for the month.

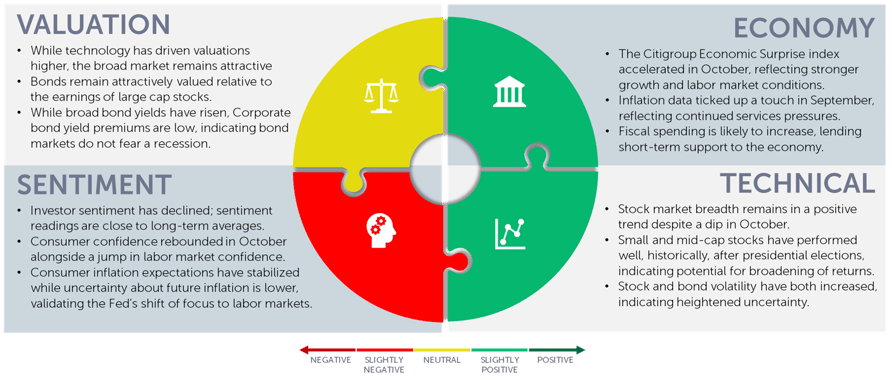

Our Navigator framework informs our outlook.

November 2024 Navigator Outlook

Economy: The Citigroup Economic Surprise index accelerated in October, reflecting stronger growth and labor market conditions during the month. Inflation data ticked up a touch in September, reflecting continued services pressures. Fiscal spending is likely to increase, lending short-term support to the economy, regardless of who wins the presidency.

Technicals: Stock market breadth remains in a positive medium-term trend despite a dip in October measures of breadth and new highs. Small and mid-cap stocks have performed well, historically, after presidential elections, indicating potential for broadening of returns in the final two months of the year. Stock and bond volatility have both increased, highlighting election-related and economic uncertainty.

Sentiment: Investor sentiment has declined; sentiment readings are close to long-term averages, reflecting a healthy balance between optimism and pessimism. Consumer confidence rebounded in October alongside a jump in labor market confidence, reversing September’s trend. Consumer inflation expectations have stabilized while uncertainty about future inflation has declined, validating the Fed’s shift of focus to labor markets.

Valuation: While technology has driven valuations higher, the broad market remains attractive. Bonds remain attractively valued relative to the earnings of large cap stocks. While bond yields have risen broadly, corporate bond yield premiums over treasury yields are quite low, indicating bond markets do not fear a recession.

Outlook and Recommendations:looking past the election to jobs and growth

In recent weekly memos we have shared our two areas of focus related to the election: 1) The deficit is likely to grow more than current budgets under both candidates 2) We should prepare for short-term volatility given the number of lawsuits already filed before election day.

The biggest mistake is letting our emotions get the best of us, taking us off our long-term plan. We noted several short-term drivers in the navigator outlook, but there are medium and long-term factors we must process:

- Valuations remain high for US large cap stocks, particularly technology, but there are many opportunities outside the concentrated market leaders. In fact, the stock market is about as concentrated as it’s ever been,[3]suggesting solid values lie beyond the largest names in smaller and international companies.

- Fiscal stimulus is a reality that won’t go away; Deficit spending is no doubt part of the reason the US economy has been so resilient, and the labor market remains strong. Deficit spending is forecast to increase under either a Trump or Harris administration.

- Intermediate and longer-term bond yields have risen since the Fed started cutting rates, indicating the market suspects that inflation may not be conquered. Paired with increased deficit spending, bond yields may have a bias to the upside. Indeed, the Fed may disappoint markets with fewer rate cuts.

- This may lead to lower growth for the US economy, bringing valuation to the fore in investor decision-making. This would reward the disciplined, diversified strategy that is the hallmark of OneAscent portfolios.

Portfolio Positioning

Our positioning reflects our long-term focus paired with active risk management:

- We remain globally diversified, with significant allocations to mid, small and International companies with lower allocations to large US stocks.

- Our portfolios are skewed towards quality stocks, likely to hold up better if the US economy experiences a recession.

- Our bond portfolios have less exposure to high yield bonds than earlier in the year. We recently shifted funds from corporate bonds, where yields are at narrow premiums to treasury bonds, to mortgage-backed bonds which have a better outlook and wider spread.

- We added a small position in Gold in our tactical sleeve to provide a buffer against short-term election volatility.

Short-term volatility is a fact of investing life. We remind investors to focus on the long-term plan, exposing your portfolio to assets with a solid risk/reward profile while managing short-term risk with prudent diversification.

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg

[2] Source: Bloomberg

[3] Source: Goldman Sachs

OAI01019