Monthly Update - May 2023

June 6, 2023 •Nathan Willis

Exploring the role of artificial intelligence:

![]() Nathan: Write me a two-sentence summary of what has driven tech stock returns this year.

Nathan: Write me a two-sentence summary of what has driven tech stock returns this year.

![]() ChatGPT: Tech stock returns have been primarily driven by factors such as increased demand for tech products and services due to digital transformation, low interest rates prompting investors to seek higher returns, and the accelerated adoption of remote work and digital solutions during the pandemic. Additionally, ongoing innovation in emerging technologies and the long-term growth potential of the sector have contributed to the strong performance of tech stocks this year.[1]

ChatGPT: Tech stock returns have been primarily driven by factors such as increased demand for tech products and services due to digital transformation, low interest rates prompting investors to seek higher returns, and the accelerated adoption of remote work and digital solutions during the pandemic. Additionally, ongoing innovation in emerging technologies and the long-term growth potential of the sector have contributed to the strong performance of tech stocks this year.[1]

If generative artificial intelligence is capable of writing part of this commentary, then maybe it can be the catalyst for a renaissance in American technological superiority.

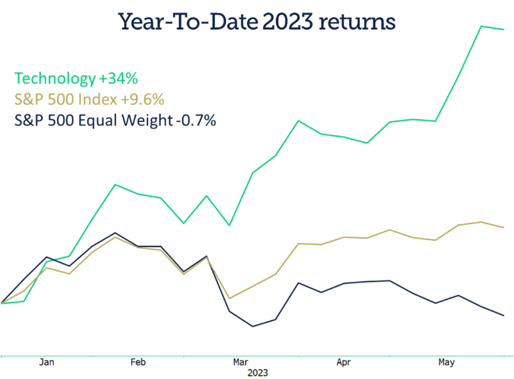

Optimism about this potential has driven a massive rally in mega-cap technology stocks this year. The S&P 500 technology index is up 32% YTD, and though the market-cap-weighted S&P 500 is up 10%, the equal-weighted version of the index is actually down for the year.[2]

Technology is the story today. But is its performance justified, and will it continue?

Before we develop a structure for answering these questions, let’s review market returns in more depth.

May Market Review

Worries about the banking system and debt ceiling debate faded into the background as technology drove returns. Narrow market leadership contradicted mediocre returns outside the mega-caps:

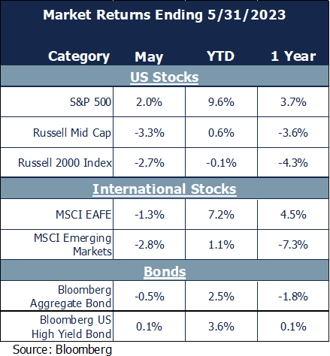

The S&P 500 led the way, up 2% in May. Nearly all other equities struggled:

- Small and mid-caps were down 2.7% and 3.3%, respectively.

- International stocks lost 1.3%. Emerging markets fared even worse, down 2.8%

- US investment-grade bonds lost ground as inflation remained sticky

- Growth dominated returns, up 4.6% while value stocks lost 4%[3]

The headline S&P 500 return appears great. Add to that the fact that the VIX, a measure of equity volatility, is at its lowest level since the pandemic[4] and the outlook appears strong. Under the surface, however, markets may not be so sanguine.

We follow our Navigator process to maintain discipline and perspective. Let’s use the process to sort through the noise.

June 2023 Navigator Outlook

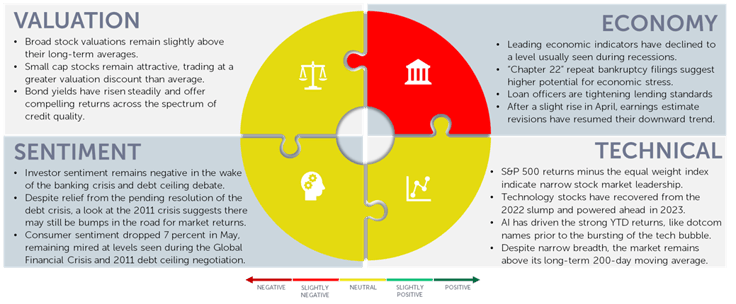

Economy: Leading economic indicators have declined to a level that suggests a formal recession is imminent. Additionally, corporate balance sheets may be strained: The level of “Chapter 22” repeat bankruptcies has reached its highest level outside of 2009, and banks are tightening lending standards to levels only seen during the tech bubble, 2008 crisis, and the pandemic. Finally, earnings estimates have resumed their decline after an April respite.

Technicals: The market is exhibiting narrow breadth, a situation which historically has preceded mediocre returns:

- The S&P 500 technology index was the worst performing sector in 2022, but 2023 gains of 33% have brought tech back into the lead in spectacular fashion.

- The market-weighted S&P 500 is 10% ahead of the equal-weighted S&P 500, a greater outperformance of the largest names than any year except 1998.

- This theme-driven outperformance is very similar to the months leading up to the 2000 dot-com crash.

Despite these concerns, the market remains solidly above its 200-day moving average, a significant level of technical support.

Sentiment: Investor sentiment remains quite negative, which is a positive for stock returns. A resolution of the debt ceiling, however, may not improve the outlook; stocks still lost money after the 2011 debt ceiling crisis was resolved. Finally, consumer sentiment has dropped to levels seen during the 2008 financial crisis.

Valuation: US stock market valuations have recovered and now sit modestly above long-term averages. Small cap and international stocks, however, remain at a valuation discount relative to US large cap stocks. Most bond sectors are attractive both relative to their recent history and relative to stocks, as yields have risen again.

Outlook and recommendations: Seeing past the hype

Investor optimism surrounding AI’s potential has moved the debt ceiling and banking crisis into the rearview mirror. Many conflicting signals compete for investors’ attention. The prudent course is to remain disciplined.

Therefore, we recommend that investors:

- Acknowledge the drastic outperformance of AI driven names. While there are likely some massive winners in the AI race as in the dot-com bull market, there are likely some companies whose business will not reach anywhere near the valuation that investors believe today. Cisco Systems, for example, was known as one of the “four horsemen of the tech boom" [5]Today the stock remains 38% below its dot-com high.[6]

- Remain diversified. We have discussed how small cap and international stocks are far less expensive than large cap stocks. The mega-cap tech names have driven almost all of the returns in 2023[7], and these names (Apple, Microsoft, Amazon, Meta, Alphabet, and Nvidia) are even more expensive than the S&P 500. They have an average valuation of 34x forward earnings, almost double that of the broad market.[8]It’s important to remain diversified while having some exposure to AI related investment themes.

- Consider alternative investments. FOMO, fear of missing out, is real and can cause us to make decisions we’ll regret later. Chasing returns in your portfolio can result in poor returns with higher volatility. Strategies with lower correlation may offer a smoother ride, providing protection from the outcomes of poor emotional decisions.

- Remain invested. Fight the urge to change course because of uncertainty and take advantage of pullbacks to invest in the proper allocation for your goals.

Despite the high likelihood of short-term market volatility, confidence in a plan and investment strategy that works for you is vital. We urge investors to talk with your trusted advisor and evaluate your plan.

[1] Source: ChatGPT ChatGPT (openai.com)

[2] Source: Bloomberg

[3] Source: Bloomberg. Growth stocks represented by Russell 3000 Growth index. Value stocks represented by Russell 3000 Value index.

[4] Source: Bloomberg

[5] The “four horsemen” of the tech boom were Microsoft, Intel, Cisco and Dell Is 'FAANG' More Dangerous Than The '4 Horsemen' Of The Late 1990s And The 'Nifty Fifty' Of The Early 1970s? | Nasdaq

[6] Source: Bloomberg

[7] Source: CNBC Big Tech carries market: Seven mega-caps drive rally (cnbc.com)

[8] Source: Bloomberg

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00300