Monthly Update - March 2025

March 3, 2025 •Nathan Willis

February Review – Trade wars lead to uncertainty and a technology selloff

Trump’s tarriff announcements on products (Steel) and countries (China, Canada and Mexico)[1] shook markets in February. Economic policy uncertainty shot up to levels last seen during the pandemic, and higher than any time in the last 25 years.[2] Uncertainty over trade policy led to concerns about economic growth which, in part, led to significant declines in expected GDP growth for the first quarter. The Atlanta Federal Reserve Bank’s first quarter “nowcast” dropped from 2.3% growth to a 2.8% decline during the last weeks of February. The measure was suggesting 3.9% growth as we entered February, highlighting the magnitude of the dropoff in expectations. Earnings estimates for stocks have declined during the month while earnings from widely watched Nvidia failed to impress; the stock dropped 8.5% the day following its earnings release. At the same time, inflation data - and expectations for future inflation - have been trending higher. This has brought fears of stagflation – economic contraction alongside inflation - to the forefront of investors minds.

Uncertainty over trade policy led to concerns about economic growth which, in part, led to significant declines in expected GDP growth for the first quarter. The Atlanta Federal Reserve Bank’s first quarter “nowcast” dropped from 2.3% growth to a 2.8% decline during the last weeks of February. The measure was suggesting 3.9% growth as we entered February, highlighting the magnitude of the dropoff in expectations. Earnings estimates for stocks have declined during the month while earnings from widely watched Nvidia failed to impress; the stock dropped 8.5% the day following its earnings release. At the same time, inflation data - and expectations for future inflation - have been trending higher. This has brought fears of stagflation – economic contraction alongside inflation - to the forefront of investors minds.

This uncertainty hit stocks hard; In particular the magnificent 7 stock market leaders of the last two years declined sharply in February. We have been warning that their high valuations might make them prone to volatility in the form of short, violent selloffs. The group finished the month in ‘correction’ territory, down over 8% for the month and more than 10% from their most recent all-time high in the middle of December.

declined sharply in February. We have been warning that their high valuations might make them prone to volatility in the form of short, violent selloffs. The group finished the month in ‘correction’ territory, down over 8% for the month and more than 10% from their most recent all-time high in the middle of December.

We will explore what this economic uncertainty might mean for your portfolio but first lets review the details of February’s selloff.

February Market Review

Stocks reacted poorly to Tarriff uncertainty, increasing inflation and slowing growth.

- US large cap stocks were down 1.3%, led to the downside by the magnificent 7 and technology stocks in general.

- Small cap stocks sold off more than large, reacting to fears of economic contraction, and are down 3% for the year.

- International markets were spared from the selloff, gaining 1.4% in February. International stocks are now firmly ahead of US stocks during the first two months of the year. Emerging market stocks remained positive as well.

- Bonds had a strong month as rates dropped on the outlook for lower growth.

Stock sector movements were consistent with the theme of slowing earnings and economic growth.

- Consumer staples, a defensive sector, turned in the best performance.

- REITs and utilities performed well, benefitting from the decline in rates during the month.

- The sectors that include the magnificent 7 stocks - Consumer discretionary, Communications, and Technology - were three of the four worst performing sectors. The sharp decline in momentum turned last year’s winners into this month’s losers as January’s “deep seek” selloff foreshadowed further volatility in tech stocks.

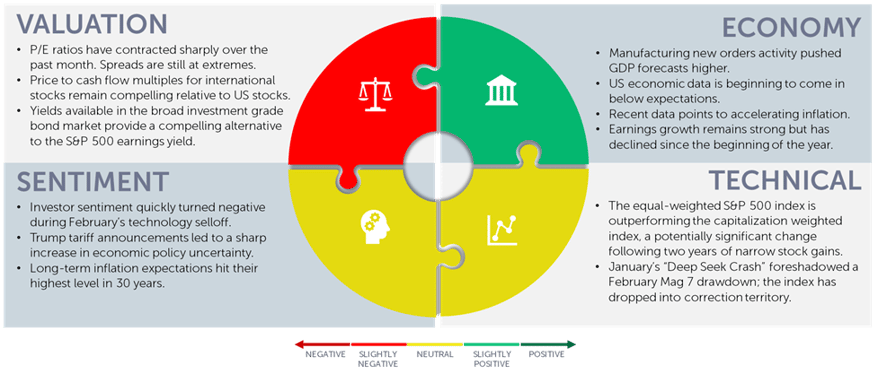

Our Navigator framework informs our outlook.

March 2025 Navigator Outlook

Economy: Economic data paints a strong, if muddled, picture. Strong manufacturing new orders activity pushed GDP forecasts higher. However, throughout the month US economic reports began to come in below expectations. Additionally, recent data points to accelerating inflation. Earnings growth remains strong, but estimates have declined since the beginning of the year.

Technicals: Technical market measures also present a mixed bag. The equal-weighted S&P 500 index is outperforming the capitalization weighted index, a potentially significant change following two years of narrow stock gains. January’s “Deep Seek Crash” foreshadowed a February Mag 7 drawdown; the index has dropped into correction territory which may be a healthy indication of rotation to new leadership or may lead to further volatility.

Sentiment: Retail Investor sentiment quickly turned negative during February’s technology-driven selloff; sharp declines in this measure are considered a positive sign for short term performance. Trump’s tariff announcements led to a sharp increase in economic policy uncertainty, hurting general sentiment. Meanwhile, long-term inflation expectations hit their highest level in 30 years.

Valuation: P/E ratios have contracted sharply over the past month. The spreads of large cap vs small valuations are still at extremes. Price to cash flow multiples for international stocks remain compelling relative to US stocks. Despite a drop in February, yields available in the broad investment grade bond market provide a compelling alternative to the S&P 500 earnings yield.

Outlook and Recommendations: Stick to your discipline

Robin McCall: I think the important thing is not to make it look like we're panicking.

President Andrew Shepherd: See, and I think the important thing is actually not to BE panicking.[3]

The Navigator framework presents some conflicting information; there is a lot of uncertainty in today’s market. When this happens, there is a tendency to react in ways we may not normally react; it’s important to remind ourselves how to stay focused on what’s important – we need to not BE panicking, when our emotions tell us to.

There are two great ways to coach ourselves: First, to recognize the cognitive biases we all have and, second, to remind ourselves of our discipline – this helps us keep focused on what we can control.

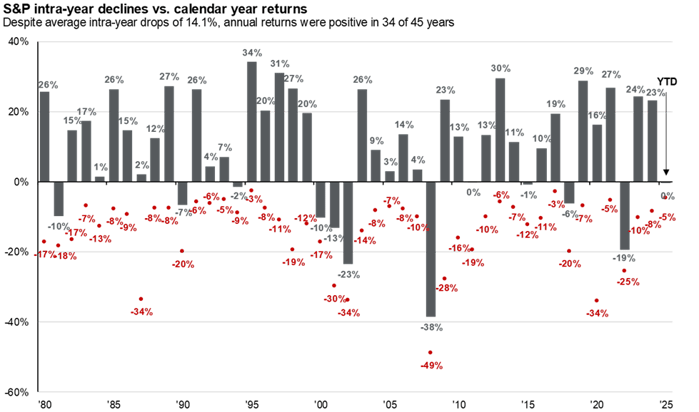

Loss aversion is one of the cognitive biases we need to address. Many psychological studies illustrate that pain from a loss is worse than the equivalent good feelings we get from a gain. We must realize, however, that short-term volatility is the price we pay to achieve solid long-term returns in the stock market. The widely used chart below, from JP Morgan, illustrates the fact that, on average, the S&P 500 gives us a 14% loss sometime during the year. We’ve only had a 5% loss so far this year. Don’t overreact!

- Values aligned – we talk about ‘investing that elevates’ in ways that promote human flourishing. We remind ourselves to focus on the long-term value our investments provide, this helps keep us from overreacting to current news.

- Globally Diversified – we find opportunities across the globe, not just in whatever market happens to be most in favor in the current moment. Today US large cap stocks are in favor but the S&P 500 is, by most accounts, expensive; we find attractive valuations in many other markets.

- Long Term – We anchor our portfolios in sensible, long-term, return expectations such as those found in our Capital Market Assumption White Paper. A moderation of the recent high stock market returns is a sensible expectation.

There are new and growing risks, such as tariffs, regional conflicts, a potential resurgence of inflation, and softening earnings estimates. There are also opportunities in today’s market; we position our portfolios for these risks and opportunities while anchoring in our discipline.

Portfolio Positioning

Our positioning reflects our long-term focus while adjusting appropriately those portfolios which have a tactical component:

- We remain globally diversified, with exposure to mid-cap, small-cap and international stocks. We acknowledge the downside risk to the equity market but remain invested in a portfolio of attractively valued assets.

- We recently increased international stocks in our tactical portfolios as their earnings momentum appears to be improving. History also shows that when international stocks outperform significantly during the first few weeks of the year, as they have in 2025, they tend to lead for the remainder of the year.[4]

- Our bond portfolios are positioned for steady, and potentially higher, interest rates, with exposure to floating rate high yield debt in our tactical sleeve and higher allocations to corporate and mortgage bonds, with fewer treasuries.

After two years of narrow market performance, diversification has begun to show its value; we are positioned to benefit from this trend, anchored in our philosophy and a sound analysis of expected returns.

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Reuters All of Trump's tariffs and threatened trade actions | Reuters

[2] Source: Economic Policy Uncertainty Index

[3] Source: The American President, directed by Rob Reiner, Starring Michael Douglass, Annette Benning, Martin Sheen, Michael J Fox, and Richard Dreyfus, Universal Pictures, 1995

[4] Source: Bloomberg (4) Activity | Gillian Wolff, CFA | LinkedIn

OAI01164