Monthly Update - June 2025

June 4, 2025 •Nathan Willis

May Review – Sunshine After the Storm

April’s market turbulence gave way to a bright May, as investor optimism fueled a 19% rally from the April lows—driven in large part by Trump’s decision to pause most “Liberation Day” tariffs. It marked the second-best May performance for the S&P 500 in the past 40 years.[1] The rebound was also supported by solid Q1 earnings, a resilient consumer, stable inflation, and a steady 4.2% unemployment rate—plenty of sunshine, indeed.

performance for the S&P 500 in the past 40 years.[1] The rebound was also supported by solid Q1 earnings, a resilient consumer, stable inflation, and a steady 4.2% unemployment rate—plenty of sunshine, indeed.

We’ll explore the implications of the sharp recovery in the outlook section, but the volatility we’ve seen this year reinforces a critical lesson: effective risk management is essential. The S&P 500 dropped 15% by April 8, and it took a 19% rebound just to bring the index slightly above breakeven for the year. Recovering from losses requires disproportionately larger gains, which is why diversified portfolios are so valuable. A well-constructed portfolio is better equipped to withstand market drawdowns and reduce overall volatility.

One of the most significant developments in May came mid-month, when Moody’s downgraded U.S. Treasury debt from AAA to AA1—joining S&P (2011) and Fitch (2013). The downgrade was driven by rising government borrowing and increasing debt service costs. As shown in the charts below, Treasury yields have climbed (left chart), reflecting the growing burden of debt service as a share of government revenue.

Before we explore how the US fiscal situation affects the market outlook, let’s review last month:

May Market Review

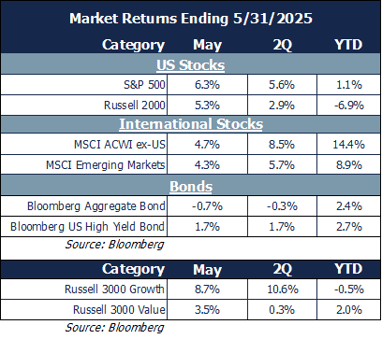

Stocks continued their strong recovery as tariff concerns eased:

- U.S. equities led the way in May, with large-cap stocks slightly outperforming and maintaining a strong year-to-date lead over small caps.

- Growth stocks rebounded sharply, reversing their underperformance through April.

- A weaker dollar and attractive valuations fueled strong international equity gains, helping them preserve a double-digit lead over US markets for the year.

- Investment-grade bonds were slightly negative, while high-yield bonds benefited from reduced recession fears and lower expectations for corporate bankruptcies.

Sector performance signaled a renewed appetite for risk:

- Seven sectors rose 3% or more in May

- Technology led with a 10.9% surge, followed closely by communications (+9.6%) and consumer discretionary (+9.4%).

- The ‘magnificent 7’ stocks rebounded sharply, gaining 15% as investors returned to recent market leaders and bought the dip.

- Healthcare was the only sector to decline, dragged down by a 26% drop in UnitedHealthcare after it lowered earnings guidance due to rising costs.

Our Navigator framework informs our outlook.

June 2025 Navigator Outlook

Economy: Core PCE, the Federal Reserve’s preferred inflation gauge, continued its decline in May, reinforcing the disinflation trend. Despite ongoing uncertainty, economic growth data surprised to the upside during the month. Earnings revisions have been a headwind for equities this year, with large-cap stocks seeing the most significant downward adjustments.

Technicals: Lower volatility helped push stocks into positive territory for the year, thought they remain below their February highs. Market breadth in US equities is showing gradual improvement. International markets have seen stronger participation, with advance/decline trends now exceeding their 2024 average – indicating broader strength than US markets.

Sentiment: Credit Default Swap (CDS) pricing indicates a deterioration in US credit quality, aligning with Moody’s recent downgrade of US Treasury debt. Rising tariff uncertainty is increasingly evident in corporate earnings calls and investor presentations. While investor sentiment remains bearish, it has improved slightly from the extreme pessimism seen during April’s market declines.

Valuation: International equities continue to trade at a notable valuation discount relative to the S&P 500, partly due to the S&P’s heavier weighting in high-growth technology stocks. Mid-cap stocks are also attractively priced, trading at a substantial discount to large caps based on free cash flow metrics. Bonds have regained appeal in portfolios, though credit spreads remain tight, suggesting limited compensation for credit risk.

Outlook and Recommendations: Bull markets, the TACO trade and your future

At the start of 2025, markets were optimistic about a business-friendly Trump administration that could support continued economic growth and broaden both earnings and market participation. However, high valuations and the potential for volatility were already on our radar. Since then, Trump’s tariff strategy has significantly altered the market landscape. The dollar has weakened, recession risks have risen, and volatility has surged—meeting, if not exceeding, our expectations. Despite the geopolitical noise, the market’s behavior still aligns with historical bull market pattern.

If we consider September 2022 as the start of the current bull market, we are now in its third year. Looking back at the 13 major bull markets since the 1950s, a clear pattern emerges: the first two years typically deliver strong gains, while the third year tends to be more muted—averaging only a few percentage points—before momentum picks up again in year four. So far in 2025, returns are flat through May, which fits this historical pattern. While we’re not forecasting specific outcomes, it’s possible that the market offers limited upside in the near term, with tactical opportunities along the way.

Whether the market can push through to stronger gains in year four—or gets tripped up by headwinds like tariffs, earnings pressure, slowing growth, or the growing fiscal deficit—remains to be seen. We’re preparing for both possibilities.

Trump’s tariff policy has undoubtedly added to the volatility. The so-called “TACO trade” (Trump Always Chickens Out) wasn’t part of anyone’s investment thesis entering the year, but it’s become a defining feature of the current environment. While the outlook continues to shift rapidly, the worst-case economic scenarios appear unlikely. U.S. companies are resilient, and growth remains the natural state of the American economy.[2]

Trump’s tariff policy has undoubtedly added to the volatility. The so-called “TACO trade” (Trump Always Chickens Out) wasn’t part of anyone’s investment thesis entering the year, but it’s become a defining feature of the current environment. While the outlook continues to shift rapidly, the worst-case economic scenarios appear unlikely. U.S. companies are resilient, and growth remains the natural state of the American economy.[2]

Portfolio Construction and Positioning

Despite the likelihood of continued volatility stemming from tariffs, political uncertainty, and broader market risks, we continue to emphasize the importance of diversification. A well-diversified portfolio remains the best way to capture upside potential while managing downside risk—especially in an environment marked by elevated valuations and an uncertain economic outlook.

Our Navigator process helps guides both short- and medium-term adjustments:

- We’ve increased allocations to international and emerging market equities, where earnings trends are currently more favorable than in the U.S.

- We’ve reduced exposure to high-yield bonds throughout the year, reallocating toward sectors like mortgage-backed securities that offer a more attractive risk-reward profile

Looking further ahead, we’re also focused on several long-term positioning themes:

- Alternative investments may enhance portfolio resilience by offering both downside protection through hedging strategies and upside potential through private market opportunities.

- Fixed income has become more compelling, with the broad bond market now yielding nearly 2% above inflation—its most attractive real yield since 2011.

- Mid-cap equities remain a key overweight in our portfolios, as their relative valuations offer strong potential for long-term, risk-adjusted returns.

Our goal is to build portfolios that are resilient and capable of compounding effectively over time. That means staying invested, staying diversified, and staying disciplined. While risks remain, the sharp rebound since the April lows is a clear reminder that stepping out of the market is rarely a winning strategy.

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg

[2] Source: Bloomberg

OAI01258