Monthly Update - July 2025

July 7, 2025 •Peter Klingelhofer

June Review – New Highs Culminate First Half

April showers brought May flowers and the recovery tune continued playing through June. By the end of the second quarter, the S&P 500 notched “its fastest-ever recovery from a bear-market drawdown" according to an intra-day data analysis by Bloomberg author Cameron Crise.[1] In just 89 days, the index to reached new all-time highs, posting a 24.5% gain from the April 8th closing low through the end of the quarter.[2] Notably, the duration of the drawdown matched the 1998 LTCM crisis, a rare historical parallel suggesting such rapid recoveries occur only under exceptional circumstances.

Historical data on market recoveries to new highs shows that investors typically feel energized by the positive momentum. With losses largely erased, the relief of recovery fosters renewed confidence. Our most recent weekly market update, highlighted that investing at new highs has consistently delivered strong 1-year forward returns, reinforcing the trend.

However, the market’s enthusiasm presents a challenge for valuation-conscious investors. Historically, paying over 20x forward earnings has led to below-average long-term returns, and the S&P 500’s forward P/E stood at 22x at quarter-end. This tension between short-term momentum and long-term valuation explains the juxtaposed views of near-term optimism and experiential caution.

Before we delve further into the market outlook, let’s review last month:

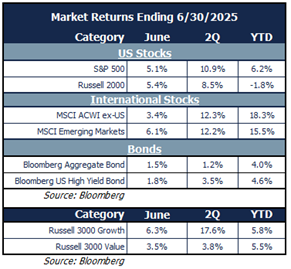

June Market Review

Stocks sustained their strong recovery as tariff worries eased, Middle East flare-up concerns were contained and progress on the “One, Big, Beautiful Bill Act”.

- Small caps stocks edged out large caps ever so slightly, though large caps retain a significant year-to-date advantage.

- Growth stocks continued their torrid rally, shining brightly in the second quarter.

- Continued dollar weakness and attractive valuations propelled international equities to the top of the leaderboard for the first half and emerging markets picked up steam in June.

- Investment-grade and high-yield bonds rose as interest rates interest rates declined in late June on the back of slowing growth, contained inflation data and dovish comments from Fed Governors.

Sector performance signaled a renewed appetite for risk:

- All sectors except consumer staples rose in June and most sectors are positive year-to-date (only healthcare and consumer discretionary are down).

- Technology led again with a 9.8% surge, followed by communications (+7.3%) and energy (+4.8%).

- Defensive sectors, healthcare, utilities, real estate and consumer staples, lagged as investors embraced risk-on mentality.

- Industrial and financials were middle of the pack in June but continued to provide very strong returns on a year-to-date basis. Industrials have led performance through the first half of the year.

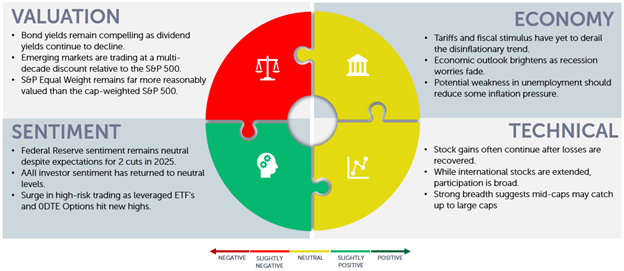

Our Navigator framework informs our outlook.

July 2025 Navigator Outlook

Economy: Tariffs and fiscal stimulus have yet to derail the disinflationary trend. Economic outlook brightens as recession worries fade. Potential weakness in unemployment should reduce some inflation pressure.

Technicals: Stock gains often continue after losses are recovered. While international stocks are extended, participation is broad. Strong breadth suggests mid-caps catch up to large caps.

Sentiment: Federal Reserve sentiment remains neutral despite expectations for 2 rate cuts in 2025. AAII investor sentiment has returned to neutral levels. Surge in high-risk trading as leveraged ETF’s and 0DTE Options hit new highs.

Valuation: Bond yields remain compelling as dividend yields continue to decline. Emerging markets are trading at a multi-decade discount compared to the S&P 500. S&P 500 Equal Weight remains far more reasonably valued than the cap-weighted index.

Outlook and Recommendations: Anticipation of lower rates continues

The oft quoted adage that “the market climbs a wall of worry” could not be more apropos to describe the current investment landscape. While short-term momentum overshadows long-term valuation concerns, the passage of the “One, Big, Beautiful Bill Act” introduces both opportunities and challenges. The bill supports near-term economic growth through increased spending but raises concerns about long-term debt and deficits. The currency market reflects this tension, with the Bloomberg US Dollar Index down over 11% year-to-date as of the 4th of July weekend.

The US dollar faces additional pressures from uncertainty surrounding the independence of the Federal Reserve. Recent criticism of Chair Jerome Powell’s conservative interest rate approach, coupled with speculation about his replacement by May 2026, has raised concerns about monetary policy stability. The Fed, acknowledging benign inflation and a softening employment outlook, has adopted a wait-and-see stance. If inflation remains contained through the summer, rate cuts of up to 50 basis points are anticipated in the second half of 2025.

inflation and a softening employment outlook, has adopted a wait-and-see stance. If inflation remains contained through the summer, rate cuts of up to 50 basis points are anticipated in the second half of 2025.

The fiscal and monetary issues that have plagued the US Dollar in 2025 have also supported the benefits of global diversification as MSCI ACWI ex-US outdistanced the S&P 500 by just over 12% through June. Despite these complexities, expectations of renewed rate cuts this fall underpin equity market enthusiasm. While profit growth may slow due to tariff concerns and consumer caution, U.S. companies and the service-driven economy continue to demonstrate resilience, further supporting the confidence of US investors.

Portfolio Construction and Positioning

The market’s dichotomies are evident in performance data. For example, Liz Ann Sonders of Charles Schwab noted that the S&P Growth Index outperformed the S&P Value Index by the widest margin since the mid-1990s as shown in the chart below.

We have highlighted the importance of diversification throughout the year and the dichotomy between growth and value and domestic and international performance in 2025 couldn’t provide a more emphatic rationale to maintain a well-diversified portfolio.

Our Navigator process helps guides both short- and medium-term adjustments:

- We’ve adjusted allocations within international exposure by shifting modestly more exposure to emerging market equities, where earnings trends and valuations are currently more favorable than in the U.S.

- We eliminated mid-cap exposure in the Navigator (but maintain a core strategic overweight due to extremely attractive valuation); we introduced a position in Technology due to its current momentum and relative earnings strength.

- We’ve modestly increased exposure to mortgage-backed securities that offer an attractive risk-reward profile.

- We adjusted overall equity exposure down slightly to offset the more aggressive equity exposure in Technology compared to mid-cap value.

Looking further ahead, we’re also focused on several long-term positioning themes:

- Alternative investments may enhance portfolio resilience by offering both downside protection through hedging strategies and upside potential through private market opportunities.

- Fixed income has become more compelling, with the broad bond market now yielding nearly 2% above inflation—its most attractive real yield since 2011.

- Mid-cap equities remain a key overweight in our portfolios, as their relative valuations offer strong potential for long-term, risk-adjusted returns.

Our goal is to build portfolios that are resilient and capable of compounding effectively over time. While risks remain, the sharp rebound in the second quarter is a testament to sticking with a low turnover strategy that adheres to discipline and diversification.

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg article “It Feels Like I’ve Woken Up Back in November of 1998” by Cameron Crise.

[2] Source: Bloomberg article “It Feels Like I’ve Woken Up Back in November of 1998” by Cameron Crise.

OAI01258