Monthly Update - July 2023

August 7, 2023 •Nathan Willis

Michael Jordan teaches economics

In the 1990s, Spike Lee made a series of commercials for Air Jordan's featuring the contrast between the shoes and the man: “This is something you can buy. This is something you cannot do".[1]

The economy feels a little bit like this today – We can buy the S&P 500, but how is the economy doing that!? Data is coming in better than expected: GDP is higher than expected, inflation is lower than expected, and the Fed has finished – or almost finished – raising interest rates. Confidence is high, and stocks are roaring forward.

But there are some gravitational pulls: Valuations are rich, banks are lending less, and companies are borrowing less. The spike in mortgage rates and the resumption of student loan payments put the resiliency of the US consumer at risk; despite a low unemployment rate, wage growth has barely kept up with inflation.

Michael Jordan’s dunks won championships, but he always came back to earth. The key questions for the economy today are when will it land and how hard will the landing be? Before we answer these questions, let’s review July performance.

July Market Review

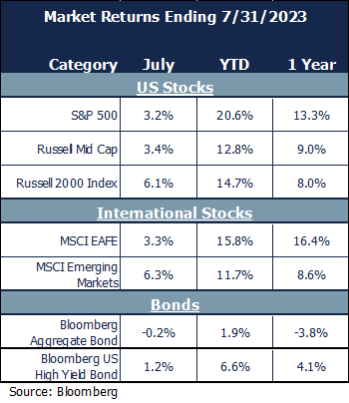

Stocks continued to power forward:

- Small cap and emerging market stocks – the riskiest parts of the market - led the way. Each gained over 6% for the month.

- Quality bonds dropped slightly while high yield performed well as recession fears eased.

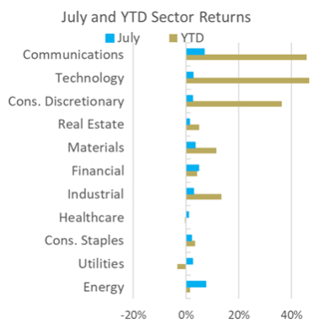

- June’s broad sector performance continued.

- Value and growth stocks both turned in solid performances for the month.

Let us now turn to the outlook, which we filter through our Navigator process.

July 2023 Navigator Outlook

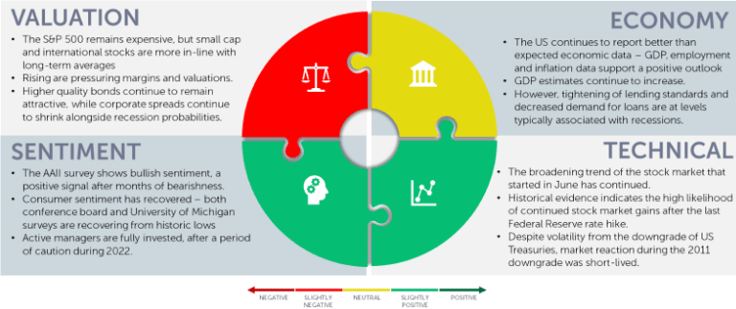

Economy: The US continues to report better than expected economic data – GDP, employment and inflation data support a positive outlook. This is causing 3rd quarter GDP estimates to increase. One note of caution lies in the banking sector: banks are tightening lending standards and corporate borrowers are reducing demand. Both levels have been associated with recessions in the past.

Technicals: The solid market breadth in June continued in July as all sectors reported positive returns, the equal-weighted S&P 500 performed in-line with the cap-weighted S&P 500, and value stocks kept up with growth. Stocks usually gain after the last Fed hike – although recent gains are far more than typical gains leading up to the last hike. The US debt was downgraded, but the 2011 downgrade did not lead to a significant drawdown in stocks.

Sentiment: After spending more than a year in negative territory, Investor sentiment continues its positive run. Consumer sentiment has also recovered from the historic lows of 2022. Active stock managers are back to a fully invested posture, after drifting to a much more cautious level of portfolio positioning in 2022. If they remain invested, that may support the overall market.

Valuation: The S&P 500 continues to get more expensive, both relative to bonds and to other stock markets. In contrast, international and small cap stocks remain at a significant valuation discount to the S&P 500, having remained more in-line with their long-term averages. Bonds remain attractive, but corporate bond spreads continue to shrink as the market’s perception of recession risk shrinks.

Outlook and recommendations: Soft landing, hard landing or “no-landing”?

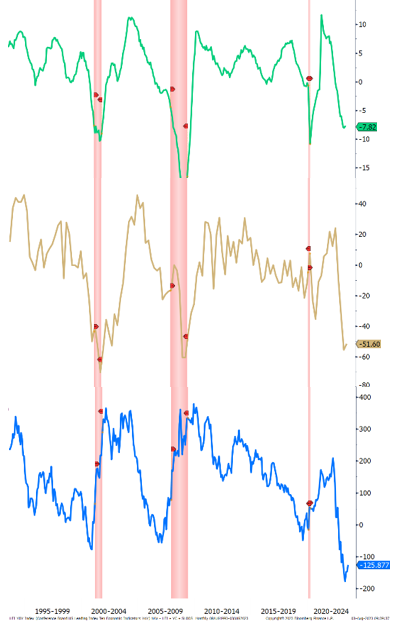

July presented us with a lot of positive economic news about what is happening now; we also need to account for what is likely to happen. Consider the following points, looking at 25-years of data:

- The Conference board index of leading economic indicators (green) is -7.82. Negative index values have historically been associated with recessions(shaded in red).

- More than 50% of banks are reporting shrinking loan demand (yellow). More than 50% of banks are also raising their lending standards. Both factors usually occur before or during recessions.

- The Yield curve, (blue – the difference between the 3-month and 10-year treasuries) is quite negative and has been for a year. The more negative the curve is, and the longer the inversion persists, the higher likelihood of recession.

These two leading indicators, and the market expectations illustrated by the yield curve, give us pause despite the positive picture painted by the technical and sentiment readings we follow.

We don’t know if we’ll have a hard landing, soft landing, or if the economy will reaccelerate. The market, and Wall Street economists, put a soft-landing scenario as the highest probability; we need to be prepared for all scenarios.

Our advice to investors:

- Remember to rebalance your portfolio. Consider the natural discipline of buying low and selling high when you rebalance out of your winners into underperforming assets.

- Remain diversified. The dominance of mega-cap growth stocks has left behind many areas that are attractive: value, small cap, and international stocks all present compelling opportunities.

- Don’t try to time the market, but don’t abandon alternative investments. They have underperformed YTD, but they meet a crucial need in many portfolios.

- Remain invested. Taking these points to heart will help maintain discipline.

We don’t know if tech stocks will continue their strong run, or if the economy will fall off a cliff in the second half of the year. It is vital to make sure you have a plan now, while the market is doing well, not later during a drawdown, when your decision-making may be clouded. Talk with your trusted advisor and evaluate your plan.

[1] Source: Youtube

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00393