Monthly Update - December 2024

December 2, 2024 •Peter Klingelhofer

November Review – Euphoric election response shifting to policy implications

Domestic equities rallied in dramatic fashion post-election, ending the month with impressive results as small and mid-cap equities outperformed large cap equities by wide margins. The same excitement was not extended to the international markets, however. Developed and Emerging market equities struggled under the blowing winds of tariff fears and the negative implications of policy adjustments currently expected under the Trump administration in 2025.

The optimism of US equity investors is clearly represented by the chart above from The Conference Board.[1]The chart demonstrates a break-out to new-highs for the percent of respondents answering positively to the following question: “Do you think stock prices will be higher over the next 12 months?” While this chart of consumer expectations reflects the current wave of confidence in equities, it does not appear that consumers are appropriately calibrating their expectations for the different set of circumstances facing President Trump compared to 8 years ago.

The table on the previous page highlights the differences in current market dynamics compared to the environment that President Trump inherited in 2016. PE’s and earnings expectations are materially higher; interest rates are much higher; the inflation rate is firmly above the Fed’s target level now while it was below the Fed’s target level 8 years ago; and the budget deficit has more than doubled.

Long-term returns from equities diminish as the price-to-earnings ratio rises above 20. We are in the process of updating our Capital Market Assumptions for 2025 and our historical framework demonstrates that higher starting valuations imply lower expected returns over subsequent timeframes. Therefore, investors would be wise to be vigilant of risk management in times of frothy valuations.

It should be noted that the Fed was holding the Fed Funds Rate below the level of inflation in 2016 to support growth in economic activity. For the last 2 years the Fed has been holding the Fed Funds Rate above the level of inflation to slow the impulse of economic activity and to reduce the growth rate of inflation. In addition, the combination of higher rates and a much wider budget deficit has given rise to a dramatic increase in the cost of interest on government debt as we have highlighted in our recent White Paper titled, “The Coming Debt Crisis – and What to Do about It.” The incoming Treasury Secretary, Scott Bessent, has a gargantuan task at hand to reduce the budget deficit to a more reasonable level over the next four years.

These factors may not matter for the balance of 2024, but they are likely to play an increasing role in the outlook for risk assets after the inauguration in January.

November Market Review

Stocks surged in November on the back of ‘animal spirits’ and the excitement of a return to an ‘America First’ theme:

- Large cap stocks rallied by nearly 6%, while small and mid-cap stocks jumped by 11% and 9.8%, respectively!

- International and Emerging Markets retreated due to anticipated negative implications from tariff fears and the associated impact on global trade.

- Investment grade bonds improved as 10-year Treasury rates ended the month lower.

- Technology, communications and materials all lagged the market due to international revenue exposure and global growth concerns.

- High Yield bonds progressed on lower rates and a modest boost in risk appetite.

Stock sector movements were consistent with a pro-growth stance supported by the ‘America First’ theme and the avoidance of international revenue exposure:

- Consumer discretionary, financials, and industrials led the charge with very strong performance. Energy also managed to outperform even though the oil price was flattish on the month.

- Higher yielding, defensive sectors - Consumer Staples, Real Estate, Utilities – lagged the market, but showed positive gains.

- Healthcare, also defensive, was the worst performer for the month due to policy concerns that may be in store with the change in administration.

- Technology, communications and materials all lagged the market due to international revenue exposure and global growth concerns.

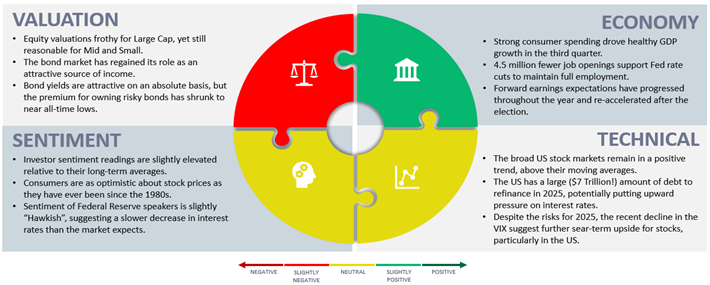

Our Navigator framework informs our outlook.

December 2024 Navigator Outlook

Economy: Strong consumer spending supported healthy GDP growth of 2.8% in the third quarter. There are now 4.5 million fewer job openings compared to two years ago and sensitivity to the unemployment rate should continue to provide support for additional Fed rate cuts. The earnings outlook has progressed throughout the year and has shown a re-accelerating trend since the election.

Technicals: The broad US equity market remains in a positive trend, with many indices trading firmly above moving averages. Despite risks that may emerge from policy uncertainty in 2025, the recent decline in the VIX suggests further near-term upside for stocks, particularly in the US. However, the US does have a rather sizable load of debt ($7 trillion) to refinance in 2025, indicating the potential for upward pressure on interest rates in the coming year.

Sentiment: Investor sentiment readings are slightly elevated relative to long-term averages, reflecting a strong dose of optimism. Consumers are as optimistic about stock prices as they have ever been according to the chart from the Conference Board. Sentiment of Federal Reserve speakers is slightly “hawkish”, suggesting a slower pace in the decreasing trend in interest rates than the market has been anticipating.

Valuation: Mega-caps and high-growth technology stocks have driven large cap valuations to roughly 27x trailing earnings. Yet, valuations for small and mid-cap companies remain reasonable. Bond yields are attractive on an absolute basis, but the premium for owning risky bonds has shrunk to near all-time lows.

Outlook and Recommendations: looking past the election to jobs and growth

In recent communications we have focused our attention on valuations and the implications of a persistently high budget deficit. Even though large cap valuations remain at the high end of historical ranges, there are areas of the market that still offer compelling returns. Eventually, the realities of our fiscal position will have to be addressed even if some of the short-term drivers in the navigator outlook remain neutral to constructive on the near-term outlook.

- Valuations remain high for US large cap stocks as forward PE ratios for the S&P 500 are running at 22x

(Table on Page 1). That number is pulled upwards by the ‘Mag-7’ so much that the ‘other 493 stocks’ trade at only 19x. As shown on the chart at right, Mid-caps are three multiple points lower still.[2] This suggests that we can still find ways to compound returns effectively within domestic equities. Our portfolios currently emphasize significant exposure to high-quality mid-caps.

(Table on Page 1). That number is pulled upwards by the ‘Mag-7’ so much that the ‘other 493 stocks’ trade at only 19x. As shown on the chart at right, Mid-caps are three multiple points lower still.[2] This suggests that we can still find ways to compound returns effectively within domestic equities. Our portfolios currently emphasize significant exposure to high-quality mid-caps. - Deficit spending is expected to continue under Trump. Estimates prior to the election indicated an acceleration of recent trends, but it is too early to determine the magnitude of adjustment. Cost cutting initiatives that could be put forth by the proposed Department of Government Efficiency and a spoken desire by the incoming Treasury Secretary (Scott Bessent) to make solid progress on the budget deficit may offer some offsets to spending. However, the current deficit level and the size of government debt obligations remain headwinds for growing our way out of the deficit.

- The potential impacts of tariffs remain relatively unknown for now. It is not clear if full implementation of President Trump’s stated plans is that likely. Tough language may create some concessions from international trading partners and the rhetoric could subside. Until tariff proposals are drafted and enacted, estimating the second order affects is nearly impossible. Nonetheless, downside risks are more likely than not.

- Taken together, these factors may lead to lower growth for the global economy and the US economy as well, highlighting the potential for earnings risk at a time of high valuations. Maintaining a disciplined focus on quality and diversification is of paramount importance at the current time and it continues to be the hallmark of OneAscent portfolios.

Portfolio Positioning

Our positioning continues to reflect our long-term focus paired with active risk management:

- While we remain globally diversified, we have reduced our outlook for international equities and emerging markets to neutral within the navigator and we eliminated our tactical position in emerging markets.

- We retain significant allocations to mid and small caps in the US with lower allocations to large cap stocks. We added to our position in mid-cap value in our tactical sleeve. Our portfolios are skewed towards quality stocks, likely to hold up better if the US economy experiences a recession.

- Interest rates rose sharply over the last couple months as the 10-year yield rose from 3.6% in mid-September to over 4.45% in mid-November. We believe this change in rates has created an opportunity to re-establish a tactical position in high yield, focused on the opportunity we see in floating rate debt and private credit spreads. Interest rates have already started to reverse as the 10-year ended the month at 4.17%.

- We eliminated our position in Gold in the tactical sleeve.

Strong market surges often happen at unexpected times. Many investors believed that a Trump victory was already discounted by the market and the market still managed to surprise investors in November, turning in the best monthly performance for the year. As always, we remind investors to focus on the long-term plan, exposing your portfolio to assets with a solid risk/reward profile while managing short-term risk with prudent diversification.

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg; The Conference Board

[2] Source: Goldman Sachs

OAI01053