Monthly Update - August 2025

August 4, 2025 •Nathan Willis

July Review – Balancing Strength and Strain

Markets entered the third quarter with a more measured tone, taking a breather after the strong rally in the first half of 2025. July was characterized by consolidation, as investors reassessed valuations and macroeconomic signals in light of evolving global dynamics.

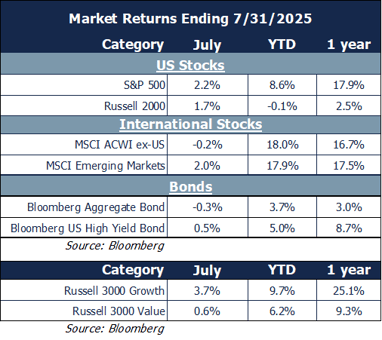

U.S. equities showed the strongest performance. The S&P 500 rose 2.2% in July, supported by stronger-than-expected corporate earnings across sectors and progress in international trade negotiations.  Both the cap-weighted and equal-weighted S&P 500 indices, along with the Nasdaq, reached new all-time highs, reflecting broad-based economic momentum.1

Both the cap-weighted and equal-weighted S&P 500 indices, along with the Nasdaq, reached new all-time highs, reflecting broad-based economic momentum.1

However, signs of economic divergence began to surface. While consumer spending remained robust, the labor market showed signs of cooling, with slowing job growth and downward revisions of prior data. This softening adds complexity to the outlook, as investors weigh the implications of elevated valuations and potential policy shifts, including concerns around central bank independence and trade tensions..

July Market Review

Corporate earnings strength and renewed trade optimism allowed US stocks to continue their strong performance trends, despite some cracks in the labor market and tension over Trump’s political pressure for the Fed to lower rates.

- Large-cap growth stocks re-accelerated on the back of strong earnings, while value sectors lagged.

- Emerging markets led international returns, benefitting from a weaker dollar and trade progress.

- Bond markets stalled as the tension between inflation and growth caused yields to increase throughout the month; however, July jobs data released on August 1 caused yields to drop sharply.2

Sector performance reflected renewed AI dominance:

- Technology and Utilities led the way, on the back of strong AI-driven earnings and expectations for infrastructure buildout.

- Industrials and Energy benefited from solid economic growth.

- Healthcare lagged due to regulatory uncertainty and company-specific setbacks.

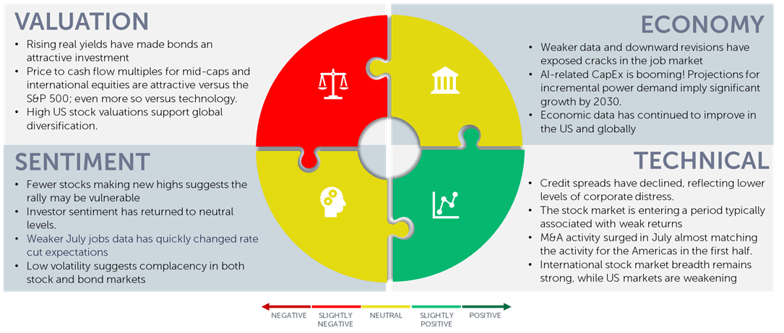

Our Navigator framework informs our outlook.

August 2025 Navigator Outlook

Economy: Weaker data and downward revisions have exposed cracks in the job market. AI-related Capex is booming, with hyperscalers like Apple, Amazon, Meta, and Microsoft expected to spend over $300 billion to expand AI infrastructure —fueling long-term economic growth. Economic data has continued to improve in the US and Globally.

Technicals: Credit spreads have narrowed, reflecting lower levels of corporate distress. The stock market is entering a period typically associated with weak returns. M&A activity surged in July, almost matching the activity for the Americas in the first half. International stock market breadth remains strong, while US markets are weakening on a relative basis.

Sentiment: Fewer stocks making new highs suggests the rally may be vulnerable, while investor sentiment has returned to neutral levels and weaker data has increased rate cut expectations. Low volatility suggests complacency in both stock and bond markets.

Valuation: Rising real yields have made bonds an attractive investment Price to cash flow multiples for mid-caps and international equities are attractive versus the S&P 500; even more so versus technology. High US stock valuations support global diversification.

Outlook and Recommendations: Implications for short, medium and long-term

As we move through late summer, markets appear to be transitioning from a momentum-driven rally with some cracks beginning to show in US stock market breadth. The Fed’s wait-and-see approach, combined with fiscal tailwinds and a softening labor market, sets the stage for potential rate cuts later this year. However, geopolitical risks — including trade tensions and concerns over central bank independence — remain key watchpoints.

The medium-term outlook depends heavily on earnings and the capex outlook for the AI-driven stocks. While 2Q earnings have increased during the month of July, driven by the mega cap technology and communications sectors, their effect on the broader economy is growing. The chart to the right shows how much capital expenditures have increased for the four major AI Hyperscalers – Apple, Amason, Meta and Microsoft are expected to spend over $300 billion to build out their AI capabilities, providing a tail-wind to the economy. This capex, paired with high levels of (reckless) government spending, is likely to support the broad economy in the near-to-intermediate term.

While the medium-term outlook is dominated by earnings and capital spending, the long-term outlook is anchored in valuation. Stocks are above their long-term valuations, as we have discussed many times in these commentaries. Bond markets, however, have returned to a more sensible level of real (inflation-adjusted) yields, as shown in the chart below. Bonds trade at a yield premium to inflation last seen 15 years ago.

Portfolio Construction and Positioning

We have highlighted the importance of diversification throughout the year, and the short, medium, and long-term outlook suggests this strategy remains sound.

Our Navigator process helps guide portfolio adjustments:

- Despite high valuations, we are slightly overweight stocks given the strong price momentum and 2Q earnings reports.

- We maintain significant allocations to international and emerging market equities, where earnings trends and valuations are currently more favorable.

- We have a strategically overweight position in mid-cap stocks but have increased the weighting of technology stocks in our tactical sleeve due to strong price momentum and relative earnings strength.

- Our bond portfolios reflect a neutral stance, as attractive yields are offset by modest credit spreads; mortgage-backed securities offer a more attractive risk-reward profile than corporate bonds.

Looking further ahead, we’re also focused on several long-term positioning themes:

- Alternative investments may enhance portfolio resilience by offering both downside protection through hedging strategies and upside potential through private market opportunities.

- Fixed income has become more compelling, with the broad bond market now yielding nearly 2% above inflation — its most attractive real yield since 2011.

- Mid-cap equities remain a key overweight in our portfolios, as their relative valuations offer strong potential for long-term, risk-adjusted returns.

Our goal is to build portfolios that are resilient and capable of compounding effectively over time. While risks remain, the sharp rebound that continued in July drives home the value of a diversified long-term plan with some flexibility to take advantage of near-term opportunities.

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg

[2] Source: Bureau of Labor Statistics, Bloomberg

OAI01304