Monthly Update - April 2023

May 3, 2023 •Nathan Willis

Confidence

Our economy relies on the banking system to function. The banking system relies on your confidence that your bank will take care of your money and fulfill your withdrawals on demand. When banks borrow money from our deposits and lend it to other people to do something like buy a home or expand a business, the difference, or “spread,” is their profit. But if we lose confidence in the bank, the situation can become unstable.

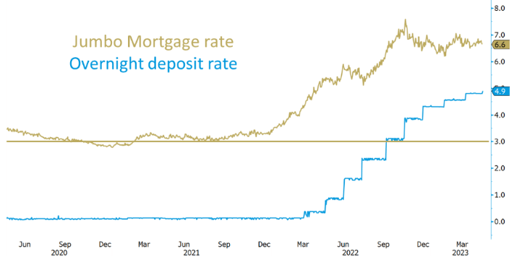

First Republic Bank failed over the weekend, the second big bank to collapse this year. It grew fast by making Jumbo mortgage loans to wealthy clients. (Silicon Valley Bank grew quickly lending to tech companies). During much of 2020 and 2021, those loans paid the bank around 3%. That made for decent profits because they were paying essentially zero interest on their checking accounts. However, when the Fed significantly raised interest rates in 2022, the bank started losing money on the loans.

Then customers lost confidence in the bank’s balance sheet and pulled their deposits, forcing the bank to sell some of those loans – at a significant loss - to cover the withdrawals. This spiraled to a point where the bank became insolvent very quickly. This caused concerns to spread across the banking system broadly which has led to a 28% YTD decline in the KBW Regional Banking index.[1]

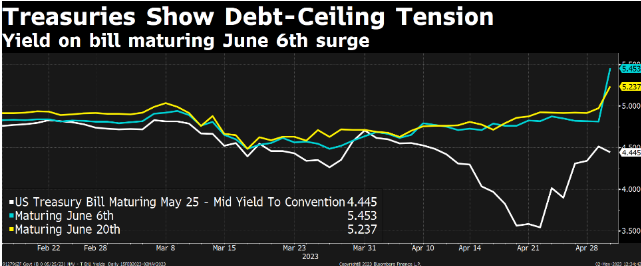

Likewise, confidence is important in government. The US government will hit the statutory debt limit around June 1. In our polarized political environment, the market is worried that the Democrats and Republicans will not reach a deal to raise the limit. The chart below shows that the market demands much higher interest for bonds that mature right after the debt ceiling deadline than right before.[2]

April Market Review

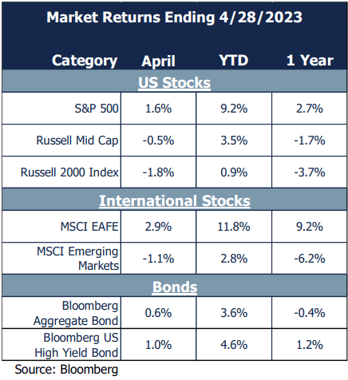

US markets were split in April as the banking crisis fed expectations of both reduced inflation and reduced growth. The S&P 500 gained 1.6% during April, driven by mega cap technology stock multiple expansion in a market with narrow leadership.[3]However, smaller stocks suffered as bank failures reduced access to credit for newer, faster growing companies.

- Small cap and emerging market stocks–more exposed to a potential recession–dropped 1.8% and 1.1%, respectively

- Developed international stocks increased 2.9% for the first quarter.

- US bonds gained slightly, maintaining a solid recovery from the losses of 2022.

Navigator Process

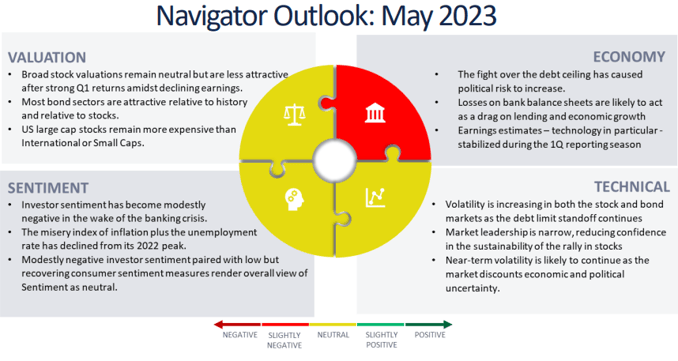

Economy: There are two significant economic headwinds–one short-term and one long-term. We will (hopefully) reach a solution to the debt limit debate before the government runs out of money in early June. The banking crisis will continue to slow lending, which will continue to slow the economy. The upside is the Fed may finally be at the end of its rate hiking cycle; this optimism may have driven the slight increase in earnings estimates we saw at the end of April.

Technicals: Technical indicators are neutral overall for stocks, but there are areas of concern. We have talked about bond market volatility, and stock market volatility has begun to increase in tandem. A small number of stocks have led the market in 2023, a worrying trend that has only increased since the banking crisis began; seven stocks with less than one quarter of the weight of the SPDR S&P 500 ETF (Apple, Microsoft, Nvidia, Meta, Amazon, Tesla, and Alphabet) have accounted for 75% of its return.[4]

Sentiment: Investor sentiment has soured, providing an area of optimism for us. Consumer surveys have moved off their lows after bottoming last year and the ‘misery index,’ inflation plus the unemployment rate, has declined steadily since peaking last year.

Valuation: On the whole, stock market valuations remain in the neutral zone. ’The Buffett indicator,’ which compares the size of the US stock market to the size of the US economy (GDP), retreated during 2022, but only to back to the highs of the 2000 tech bubble. Small cap and international Stocks, however, remain at a valuation discount to US large cap stocks. Most bond sectors are attractive both relative to their recent history and relative to stocks.

Outlook and recommendations: Evaluating our confidence

We started out this letter by talking about confidence: as we move towards the summer there are reasons for confidence and concern. Let’s highlight the concerns before talking about how to approach them:

- Political drama surrounding the debt ceiling

- The continued banking crisis and economic slowdown

- Earnings slowdown

- Trajectory of inflation and the Fed

We recommend that investors:

- Have confidence in the system: The government has proven repeatedly since the Global Financial Crisis that it will step in, taking the necessary actions to ensure the stability of the financial system.

- Acknowledge the volatility: The recovery from the banking crisis and moderation of inflation are not likely to happen overnight and there will likely be bumps in the road. Do not be surprised by volatility in the market.

- Consider alternative investments: Strategies with lower correlation may reduce portfolio volatility, offering protection from emotional decisions.

- Manage risk appropriately: OneAscent recently added a small position in a gold ETF for purposes of risk management. We view gold as a hedge against uncertainty and crisis.

- Remain invested: Fight the urge to act because of uncertainty and take advantage of pullbacks to invest in the proper allocation for your goals.

- Consider active tax management: Volatility offers opportunities to realize “tax-alpha” to improve your overall financial returns. Talk to your advisor to see where the opportunities lie.

Despite uncertainties and the high likelihood of short-term market volatility, confidence- in the

system and your investment strategy - is warranted. We urge investors to stick with your plan.

i Source: Bloomberg

ii Source: Bloomberg

iii Source: This awfully fragile narrow no-good rally | Financial Times (ft.com)

iv Source: Bloomberg

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00283