Market Review

Stocks have taken another leg down in response to a higher-than-expected Consumer Price Index reading released last Friday. This data caused the stock and bond markets to sell off, considering if stagflation is in our future and whether the Fed will raise rates more than expected this week.

Stocks have taken another leg down in response to a higher-than-expected Consumer Price Index reading released last Friday. This data caused the stock and bond markets to sell off, considering if stagflation is in our future and whether the Fed will raise rates more than expected this week.

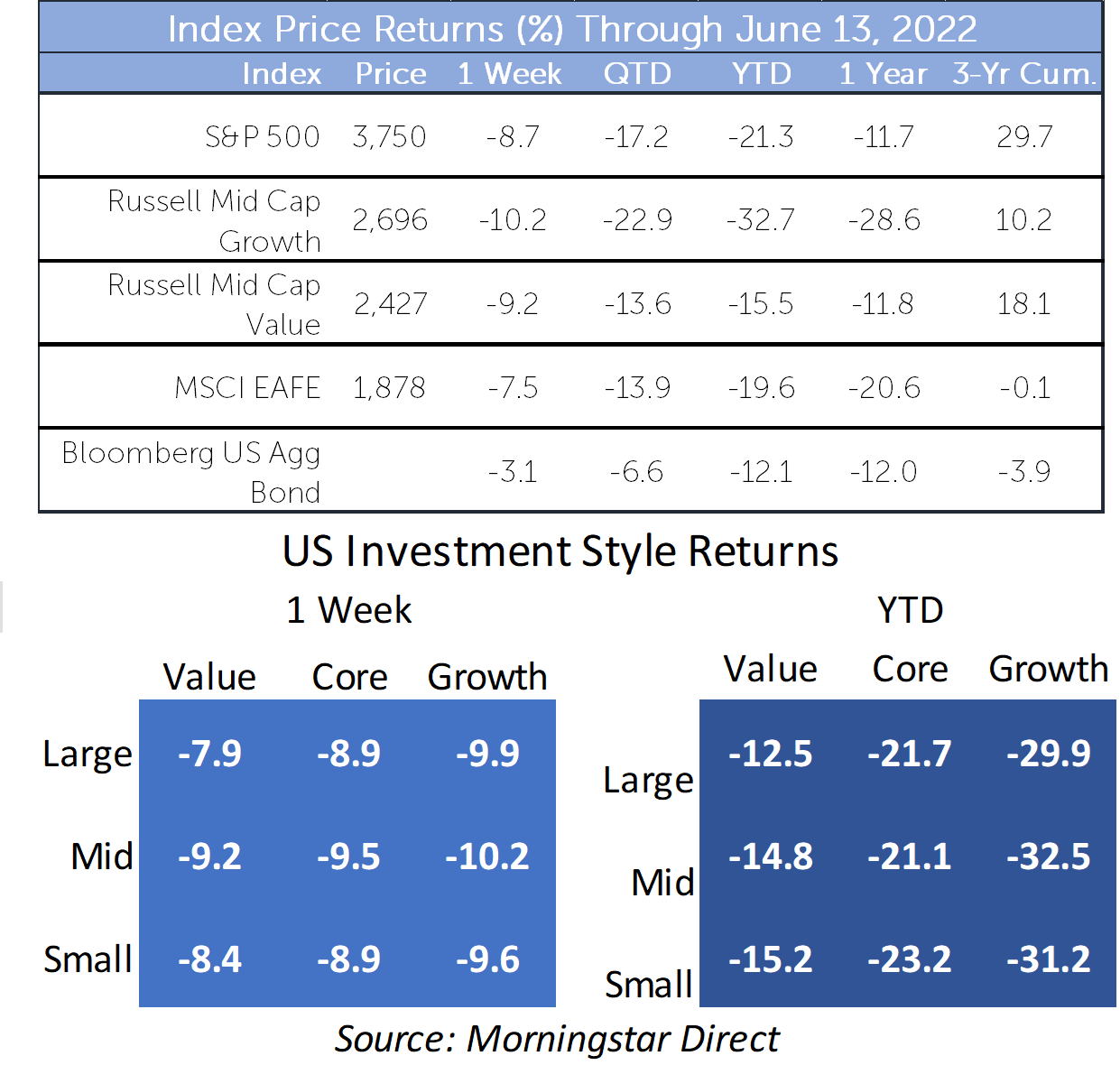

- As a result, US large cap and international stocks joined small cap securities in a bear market, down 20% from their highs. The tech-heavy NASDAQ is down 30%.

- Value stocks have lost significantly less than growth stocks so far this year.

- Bonds have continued their losses along with stocks, as increasing inflation has continued to drive rates up. (Interest rates and fixed income returns tend to have an inverse relationship.)

The Crux of the Matter

A crux can be defined several ways; my favorite, though, is the rock climber’s definition. The crux is the most difficult part of the climb, where you are most likely to fall. As investors, the current situation might feel like we’ve been hanging on for quite a while. As we maintain our grip and process the evolving set of worries in our economic lives—inflation, recession, profit growth, housing prices, and more—how do we need to think about our investment portfolios?

Maintaining Discipline

The key to success is maintaining discipline—sticking to your plan. We have, and will continue to, manage the portfolios based on the risk/reward tradeoffs we see in the market. Over the last couple of months, we shifted the portfolios in a couple of ways, and we are likely to make further moves in the future. We have:

- Reduced our exposure to mid-cap growth stocks in favor of value stocks.

- Shortened the average maturity of our bond portfolio.

- Removed a high yield bond manager from portfolios and, as we saw the market selloff accelerating, paused re-investment leaving portfolios with higher cash levels than normal.

We don’t know when the market rout will end. However, for some weeks now we have been watching the technical and sentiment patterns closely. The market appears to be proceeding through a bottoming process, but we are aware that certain conditions - such as valuations that are less expensive, but by no means cheap – suggest we may be in for more downside. A bottoming process, if that is what is happening, usually takes time. Additionally, significant government intervention or policy change is often a part of a major bottoming process. Today we would expect government actions to relieve energy price pressures but, currently, nothing is on the horizon. As we wait for the proper set of signals to increase risk in our portfolios, we remind ourselves that, while not objectively cheap, most investments are more attractive than they were 5 months ago, and the long-term prospects for the economy are still positive.

This crux is an unsettling but pivotal moment. Volatility in the short- to medium-term is the price investors pay to achieve positive long-term returns; sticking to your plan gives you the best chance to arrive at your financial destination.

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.