Investment Peaks

October 20, 2021 •Will Sorrell

At the end of 2020, I happened upon an article with a gripping headline. “What if you only invested at market peaks?”

The article comes with a short, animated YouTube video, introducing you to Bob, the ‘world’s worst investor.’ Bob only invests in the market when it is at its peak, also known as investing right before a dip or crash. Bob is the embodiment of financial nightmares.

Nevertheless, Bob retires a millionaire. How, you might ask (just as I did before checking out the math), can someone meet their retirement goals if they invest at all the wrong times? Surely, we need to time the market correctly, right? Isn’t investing at the high the worst thing we can do?

Actually, no.

At OneAscent, we believe in a long-term approach to investing. Whether you are new to the market and planning for a family trip, or you are toward the end of your career and considering retirement, we believe your dollars should be put to work toward your future.

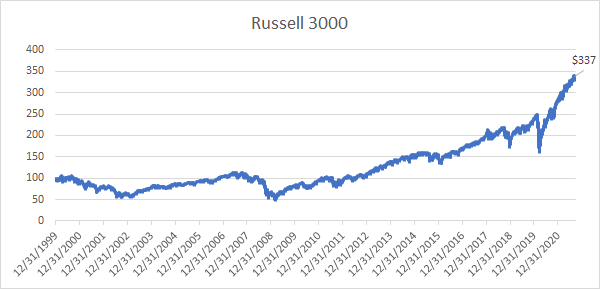

So, looking at the graphic above, let’s say you only invested right before the greatest crashes in this country’s history. You still would have netted a positive return on a 20-year basis in any of these scenarios. If you had put a chunk of cash in the S&P 500 in January 2020 right before the pandemic, it would have taken only six months for you to surpass your initial investment.

To put it another way, maybe you invested $100 in the Russell 3000 (a benchmark for the entire U.S. market) at the turn of the century. You would have endured the market halving in value twice in the next eight years, followed by a drop of one-third in the pandemic. This would have been horrible timing. Nevertheless, your investment still would have increased 237% by September 2021.

“If we’re right about a business, if we think a business is attractive, it would be very foolish for us to not take action on that because we thought something about what the market was going to do. … If you’re right about the businesses, you’ll end up doing fine.” – Warren Buffett

OneAscent focuses on investing in companies that align with your values. Our managers build conviction in the companies they select. The goal is not to time the market, but to select companies that do well by doing good for the world, regardless of what is happening in the macro-environment. This long-term perspective allows us to still pay attention to short-term volatility that can lead to new, high-conviction investments.

With all of this in mind, here are three things you could do that are often worse for your portfolio than investing at market highs:

- Investing with the wrong risk tolerance.

- Investing huge amounts of cash sporadically.

- Investing with no regard to the short-term.

Instead of these risky investing behaviors, consider the following:

- Know your risk tolerance and invest accordingly. Do you know how much risk you should be taking, and your time horizon? Our advisors are experts in helping you determine what allocation to each asset class you should adopt in order to meet your goals.

- Invest consistently and incrementally. Bob, the world’s worst investor, could have made almost $2.5 million instead of $1.1 million if he had implemented dollar cost averaging. DCA is a fancy way of saying that it’s wise to break up your investment amounts into bite-sized pieces and spread them over time in order to reduce volatility.

- Be prepared for short-term investment opportunities. While we invest with long-term goals in mind, at times the market presents opportunities that require immediate action. Our OneAscent Investment Committee meets every month to determine which asset classes are poised to outperform in the short-term, and a small percentage of our clients’ portfolios are tilted accordingly to make sure they are staying on track for the future.

To conclude, if you’re sitting on a pile of cash because you are worried about the market performing well, don’t be afraid. Work with your advisor to take the proper amount of risk, invest the money over time, and trust your management experts to help you prepare for the days ahead.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from OneAscent. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

These materials contain references to hypothetical case studies. These are presented for the purpose of demonstrating a concept or idea, and not intended to be interpreted as representing any specific person. Such representations are not intended to substitute for individual investment advice, even if the case study appears to have similar characteristics.

The S&P 500 is an unmanaged index used as a general measure of market performance. You cannot invest directly in an index. Accordingly, performance results for investment indexes do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results.