Investing lessons from March Madness

April 4, 2024 •Nathan Willis

What does your bracket have to do with your portfolio?

I messed up during March Madness in 2018. My dad and I had tickets to the games in Charlotte and headed home after watching the first game, which was an 8- vs. 9-seed. The next game, after all, was a 16-seed vs a 1-seed. We planned to watch the #1 finish mopping up at home; 16-seeds were 0-135 vs the 1-seeds up until that point.[1]

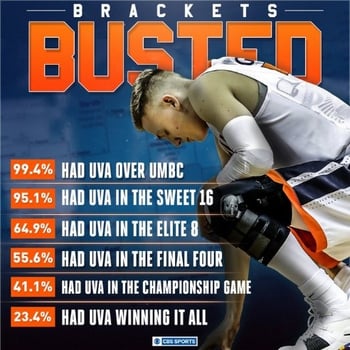

Unfortunately for me, that 16-seed was the University of Maryland-Baltimore County (the UMBC Retrievers!), and they beat 1-seed University of Virginia–the first time a #16 ever beat a #1. Ninety-nine point four percent (99.4%!) of CBS Sports brackets had UVA winning the game, and almost a quarter had them winning the tournament! I missed seeing one of the greatest upsets of all time.

But what does that have to do with your investment portfolio?

Three things come to mind:

First, it really wasn’t a big deal for me to miss seeing that upset; it did not change my life at all. For UVA fans, however, it was a catastrophic day. In investments, we call this dynamic ‘loss aversion.’ A loss tends to feel far more impactful than the equivalent gain. We cannot allow missed opportunities to color our decisions. UVA, though discouraged I’m sure, kept showing up to practice, and they won the title the following year.

Second, and more importantly, you need to be at the game to stay in the game! The second time a 16-seed (Fairleigh Dickinson) beat a 1-seed was last year, and that #1 was Purdue. But Purdue didn’t quit playing basketball after an embarrassing loss! On the contrary, they have regained their stature by making it to the Final Four this year.

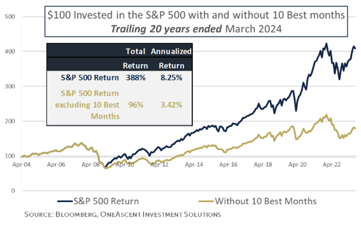

This lesson has investment implications as well. Here is an analysis we examine regularly, showing the cost of missing out on the ten best months of the last 20 years.

This lesson has investment implications as well. Here is an analysis we examine regularly, showing the cost of missing out on the ten best months of the last 20 years.

$100 invested 20 years ago would be worth over $400 today, a gain of $300 or 8.25% per year. Missing out on the ten best months, however, would have cut your returns to 3.5%. Starting with $100, you would have less than $200 today, costing 2/3 of your potential gain.

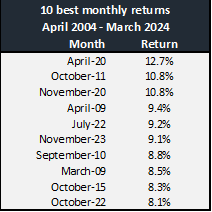

Many of the market’s best months happen during times of crisis, and times of crisis are when we are most tempted to retreat. The next chart shows those ten best months of the last 20 years:[2]

- Two of them, March and April of 2009, marked the end of the 2008 Financial Crisis.

- The largest gain, in April 2020, happened right after the 12.5% loss in March of 2020 at the height of the Pandemic.

- Two more, July and October 2022, marked two bottoms during the depths of the 2022 bear market.

- The most recent example was November of 2023 after Fed Chair Powell turned Dovish, marking a shift in interest rate policy.

No one can time the market and only capture the best months, just like no one has ever created a perfect March Madness Bracket. That's why we keep playing the game.

Third, and finally, it’s worth mentioning that the most highly ranked team rarely loses. Similarly, the most attractively valued investments usually produce quality gains, but we need to stay in the game to earn those gains! Every strategy has periods of underperformance; the key to success is avoiding a mistake when the scoreboard isn’t in our favor. We strive to build resilient portfolios that help you reach your goals—game after game, season after season.

This material is intended to be educational in nature [3], and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: CBS Sports No. 16 seed UMBC beats No. 1 Virginia in biggest NCAA Tournament upset of all time - CBSSports.com

[2] Source: There are many analyses that look at missing the best days of the market, but we are more likely to get out of the market after a longer period of loss, so we choose to think about this in terms of missing the best months.

[3] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00697